Why Digital Wallets Need to Integrate Mini-Program Ecosystem

Our way of life is quietly being altered by the COVID-19 pandemic and mini-programs.

Our way of life is quietly being altered by the COVID-19 pandemic and mini-programs.

Our way of life is quietly being altered by the COVID-19 pandemic and mini-programs.

The global outbreak of the COVID-19 pandemic in 2020 has, to a greater or lesser extent, impacted our work and lifestyles. The relentless onslaught of this disease continues, with normalized nucleic acid testing, intermittent remote work, restricted international travel, and the explosive growth of the takeaway industry. It is undeniable that these sudden changes have emerged, requiring us to adapt.

Over the past year, consumer habits have quietly shifted. According to Dong Lihua, Director of the Trade and External Economic Statistics Department of the National Bureau of Statistics, the pandemic has led to a reduction in travel, and there is a noticeable increase in online consumption for home-based needs. In 2021, the national online retail sales increased by 14.1% compared to the previous year. Among them, the online retail sales of physical goods grew by 12%, with an average growth rate of 13.4% over two years, significantly outpacing offline consumption.

The era of digital living has arrived, and alongside changing consumer behavior, payment methods have also evolved.

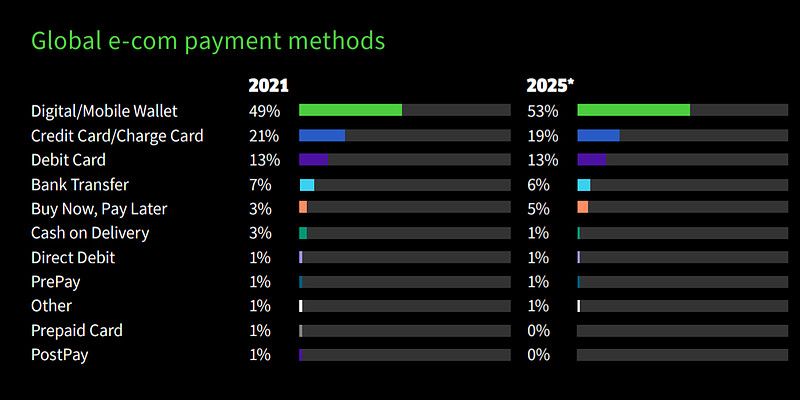

With the rapid development of the global digital economy, driven by the economic recovery worldwide in 2021, global e-commerce grew by 14%, surpassing a transaction volume of over 53 trillion USD. In 2021, "digital wallets" accounted for 49% of the global e-commerce transaction volume, reaching 2.6 trillion USD, far surpassing the second-ranking "creditcard" payments (21%).

The digital wallet industry faces robust market demand, with many emerging players competing in the market, bringing numerous challenges amid industry competition.

Wallets differentiate themselves by integrating into the payment industry chain, providing users with differentiated value—a key factor influencing users' choice of a specific type of wallet. In the latter phase of the mobile internet, major wallets such as Alipay and WeChat Wallet have already secured substantial market share with the support of the associated traffic ecosystem. As technology in the internet sector advances, the era of "everything connected" is opening a new chapter in internet users' lives. Smart communities, intelligent travel, and smart homes are reshaping the lifestyle of the new generation. User interaction with the mobile internet is no longer confined to apps; it includes smartwatches, smart TVs, smart home gateways, and more. Various industries, including the payment sector, are accelerating exploration of the integration points with Internet of Things (IoT) devices. It's rightly said, 'He who captures the entry point captures the world.'

Digital wallets consist of two ends—the account end and the user end. The account end leverages the wallet's technological advantages by integrating market data and its risk control capabilities to provide high-experience service outputs and assurance for users' transactional activities. On the other end—the user end, it merely offers a view of payment order transactions, lacking the ability to stimulate user interest and foster loyalty. In other words, while a wallet can activate certain immediate user needs, it cannot cultivate user habits, thereby failing to construct a competitive barrier for the enterprise. 'He who gains the user gains the world.' The key lies in rapidly introducing business scenarios that interest users, particularly in the context of the IoT technology revolution during the new round of competition for users.

In the second half of the mobile internet era, compared to native and HTML5 technologies, mini-programs offer users the least intrusive and most utilitarian approach, embodying the philosophy of 'on-demand, and walk away when done.' It stands out as the optimal technological presentation for reaching users in fragmented moments of time. According to Aladdin's '2021 Annual Mini-Program Internet Development White Paper,' the total number of mini-programs exceeded 7 million in 2021, with over 3 million developers for WeChat mini-programs. The daily active users (DAU) have surpassed 450 million, making it a 'standard feature' in users' lives.

Leading companies in the traffic ecosystem favor mini-program technology due to its advantages over H5 technology in development trends:

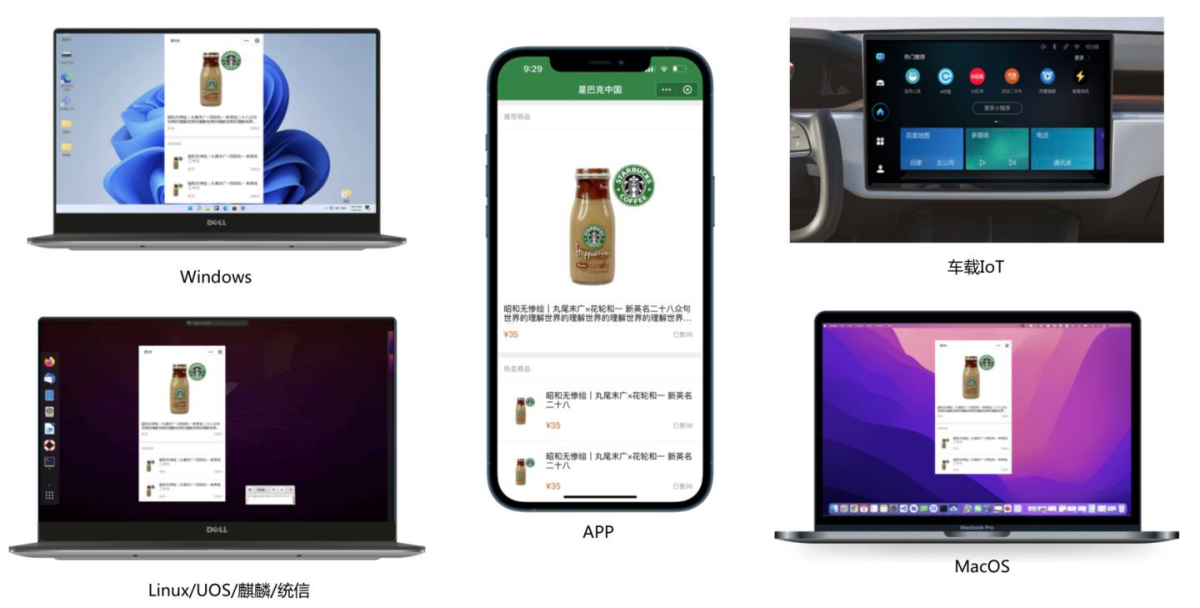

Mini-programs, like HTML5, are not exclusive to apps but an upgraded version of technology standards that can run on major browsers or app stores. With the right technological foundation, such as FinClip Mini-Program Container Technology, consumers can achieve seamless penetration and relay across devices and multiple spaces, accessing digital content and services anytime, anywhere through smartphones, smart TVs, in-car systems, and touchscreen displays in any public setting.

Imagine developing and testing once, and your mini-program can run on platforms such as Android, iOS, POS terminals, Windows, Mac, Linux, and more. This implies that mini-programs can operate on various smart terminals, including mobile, PC, IoT, and others. In other words, Mini-Program Container Technology is a cross-platform technology, even referred to as an all-encompassing technology, ensuring consistency across multiple endpoints in development."

Mobile wallet companies excel in providing high-experience service outputs and assurances for user transactions by integrating market data and leveraging their risk control advantages. Even with a technology team several times larger than Alipay's, if there is a need to build an in-house ecological business application, it's likely that they would struggle to keep up with the changing market demands of users.

Finogeeks's embedded mini-program secure sandbox, FinClip, empowers enterprises by requiring the integration of just one component on the client side to gain the ability to run mini-programs. If a company already has a mini-program ecosystem running on WeChat, they can swiftly manage the onboarding and offboarding of mini-programs through the application management feature. Similarly, businesses can rapidly and extensively bring in digital scenario partners, leveraging their mature mini-program applications and the underlying business ecosystem, to better serve their existing customers and address issues related to user interest and habit cultivation.

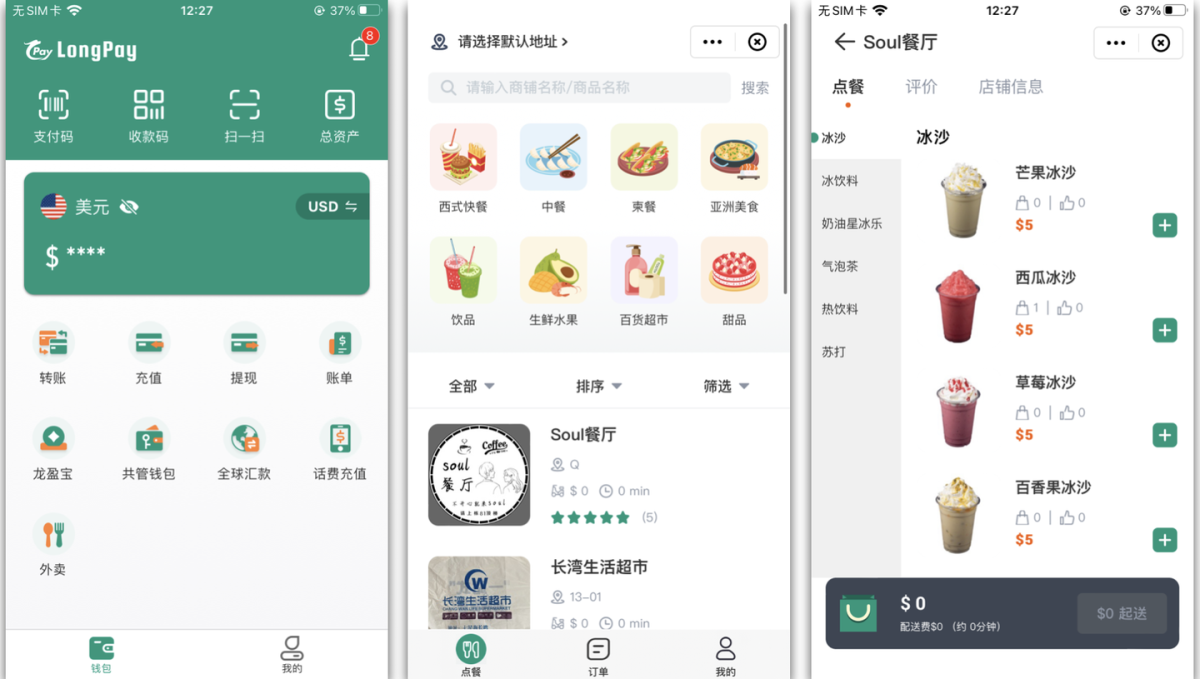

LongPay is an international wallet (website: https://www.long-pay.net, app available for download by searching 'LongPay' in the US App Store). Its target audience is the Chinese community living in Cambodia, providing them with a digital wallet and related payment services.

According to feedback from team members, the main frontend codebase of LongPay's wallet application is developed using Taro. Considering the diversification of future business and ecological expansion, the LongPay team conducted a series of technical research and selection in early 2022. Taking into account compatibility with existing business code and future scalability, the LongPay team ultimately chose to use the FinClip product.

The first mini-program launched by LongPay is a food delivery application. Users can complete the entire process of "store search - browse takeaway items - place an order - pay for the order" directly in the app. According to the team, mini-program development is user-friendly with low entry barriers. After development, the mini-program application can be quickly launched through the FinClip management platform. Once associated with the LongPay application, users can easily access this food delivery mini-program within the LongPay wallet.

Are you interested in learning more about how mini-program container technology can help businesses quickly integrate third-party ecosystems and swiftly build a mini-program ecosystem for your smart devices?

For more information, please contact us now and embark on your journey to enhance efficiency in cross-platform mini-program applications (ecosystems).