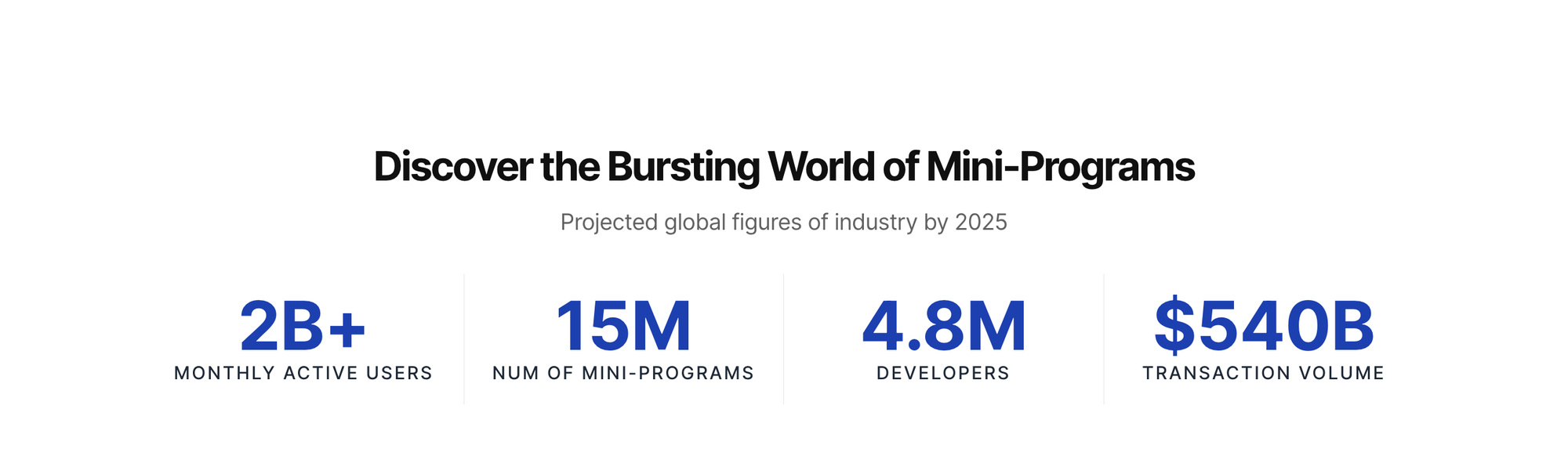

Banks Digitally Transform Via Banking SuperApp

Mini apps turn banking apps into all-in-one apps to manage multiple business scenarios.

Challenges & Our Solution

Challenges

1、 Increasingly complex IT architectureOur Solution

How to make the IT architecture of mobile applications more loosely coupled and capable of true agile development and agile delivery to cope with various online marketing scenarios.

2、Weak ecological integration capabilities

Traditional bank apps mostly provide low-frequency financial services, and users have limited dwell time in the app, which is also a low-frequency usage scenario. Financial services are difficult to deeply integrate with users' daily life and production scenarios, leading to low app activity.

3、Severe data governance risks

The content involved in bank APIs is both sensitive and complex, and the interface standards are also inconsistent, which makes it impossible to support many cooperation scenarios and cannot meet the needs of third-party partners.

Our Solution

Enhancing the Development Efficiency of Banking Apps

To enhance the development efficiency of mobile banking applications, a dynamic and scalable development architecture can be implemented. This involves integrating the FinClip SDK into the bank’s app, allowing the substitution of various business function modules with mini-programs. These mini-programs can be independently developed and tested, support hot updates, and operate without disrupting the main app. This solution effectively reduces the frequent need for banking app updates and enables quick adaptation to business requirements and rapid iteration.

Banking apps can build and own their own Mini-App store

With FinClip,Banking apps can build and own their own Mini-App store, and therefore their digital ecosystem.Through this approach, banking apps can swiftly integrate third-party mini-apps from partners, combining them with their own financial service capabilities to create distinctive financial services and enrich the use cases of their own apps.

Very strong risk-control capability

Compliance risk and security risk of Mini-App contents can be controlled in real-time by instantly deactivating Mini-Apps from user devices.Any business innovations could be tested, released and withdrawn in real-time.

Technical Advantages

Cross platform SDKs

Got 30 minutes? Embed FinClip SDK into your iOS, Android, Linux, Windows, Mac applications. And your app is instantly ready to run unlimited number of Mini-programs (or Mini-Apps, in W3C terms)

Containers with security sandbox

Digital contents & services as "Mini-programs" are downloaded, on-demand, into your App for execution in isolated, sandboxed environment. FinClip is like a container, except it runs in your app

High performance rendering engine

Customized JavaScript engine that renders contents leveraging multi-threading and aggressive caching to provide high performance that rivals native apps. Enables direct access to native device capabilities.

Case Study

A large commercial bank

A large commercial bank’s app, by integrating the FinClip SDK, has enabled the running of mini-programs within the banking app. Various service applications and marketing activities can be quickly launched or removed. Additionally, the feature of phased rollout allows for precise targeting of different customer groups. Moreover, the bank’s app can easily incorporate a vast array of high-quality internal and external mini-programs, such as those for utility payments, movie tickets, food delivery, and more.

Within 2 months, the bank was able to develop and launch 100+ Mini-Apps, each one corresponding to a business scenario in digital form