Revolutionizing Financial Inclusion: The Impact of Super Apps

With the increasing fragmentation of mobile applications on smartphones, screens are becoming increasingly crowded with trends such as service detailing and experience fragmentation. As a result, super apps, which cover a wide range of services, have risen significantly in the market. Following the success of China's super apps, more and more multinational Internet companies are taking reference from China's super apps model and launching super mobile apps that conform to local usage habits. In this article, we will introduce how super apps are changing financial inclusion.

Lowering the Threshold of Financial Services

Traditional financial services are often limited by geography, time, and high operational costs, making it difficult for many disadvantaged groups to access basic financial services. By building an online platform, China super apps breaks down these constraints and puts financial services within reach. Users only need a smartphone to enjoy diversified financial services such as money transfer, payment, and wealth management anytime and anywhere, which greatly reduces the threshold of using financial services.

Enriching Financial Service Scenarios

China super apps not only provide basic financial services, but also create rich financial service scenarios for users by combining the characteristics of its platform. For example, on e-commerce platforms, users can directly use the payment tools in super apps to complete shopping and payment. In travel services, users can also use super apps to quickly complete the payment of taxi fees. The integration of these scenarios makes financial services closer to users' daily lives and improves user experience.

Enhancing the Efficiency of Financial Services

Super App optimizes and transforms the financial service process with the help of big data, artificial intelligence, and other advanced technologies. For example, through the intelligent risk control system, it can assess the user's credit status in real-time and realize lending in seconds. Through the intelligent customer service system, it can quickly respond to the user's questions and needs and improve service efficiency. The application of these technologies not only improves the efficiency of financial services, but also reduces operational costs, providing strong support for the development of inclusive finance.

Specific Applications

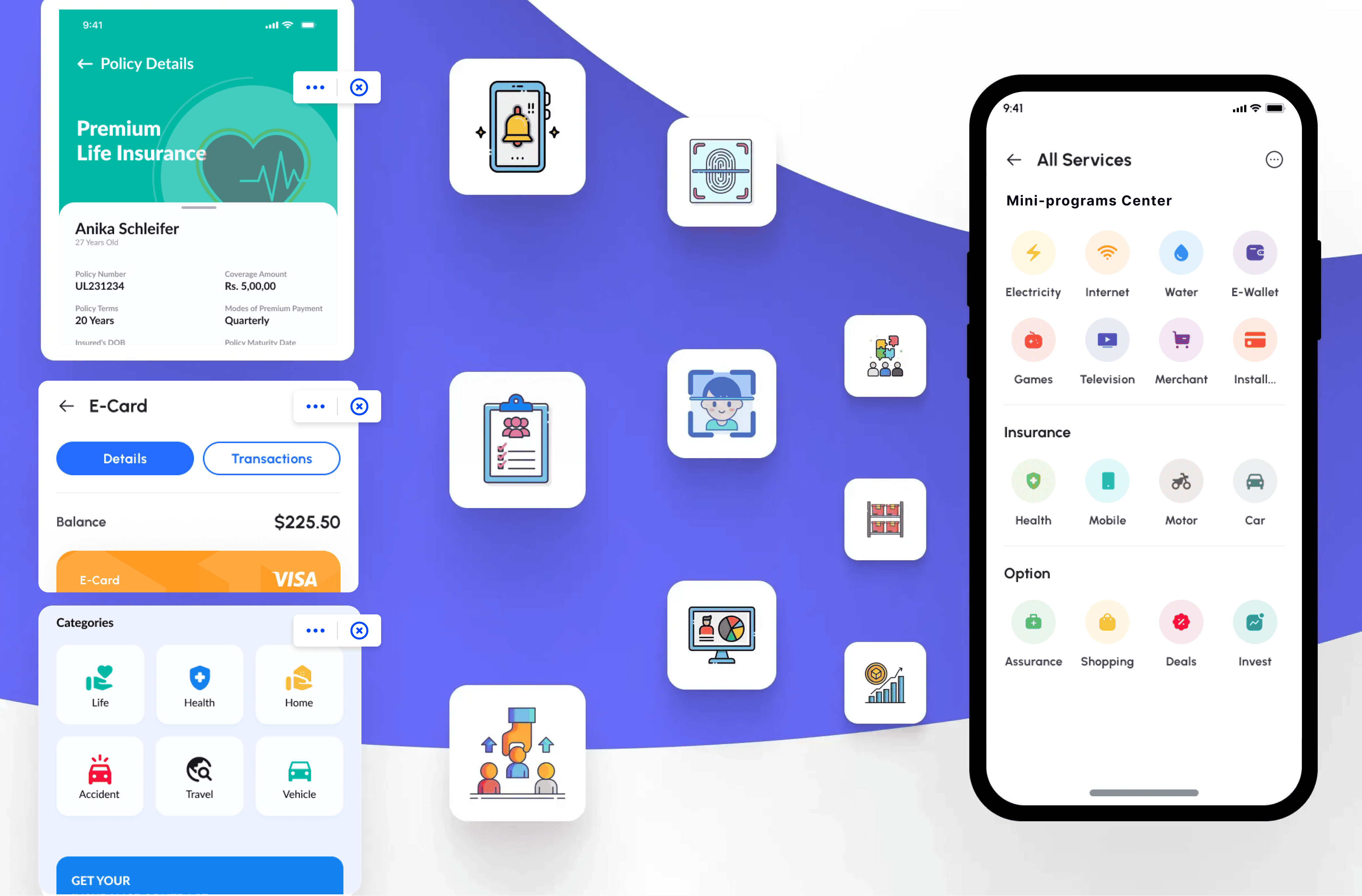

By integrating payment and authentication, and integrating various third-party services, SuperApp extends its core services to a series of peripheral products and services, thus providing users with a one-stop service experience and avoiding the inconvenience of switching between applications. At the same time, third-party service providers can also leverage the huge user base and complete ecosystem of Super Apps to better expand their business scope and customer base through plug-in services on the Super Platform.

Relying on the use of cutting-edge technology, the financial industry has changed dramatically in terms of the range of services and the business model. China super apps provide a one-stop-shop for users, and they are constantly integrating additional services, including payments and other financial services. With super apps, users can cover all their online activities: buying tickets, booking trips, and going to the movies and all their life needs through one app. By building payment methods and expanding usage scenarios, customer stickiness is increased.