The Rise of Digital Wallets: Types, Benefits, and Solutions in the Evolving Fintech Landscape

With innovations in IoT technology and the widespread adoption of smartphones, the e-wallet industry continues to grow. These virtual tools allow individuals and businesses to manage their finances more efficiently, providing an easy, secure, and contactless way to pay for goods and services. The rise of digital wallets is not just a trend; it is a transformation that is continuously evolving, driven by advancements in technology, increasing consumer demand, and the changing landscape of global finance.

According to Worldpay's 2024 Global Payments Report, payments made through digital wallets in the UK alone are projected to reach £203.5bn (US$256bn) of e-commerce transactions by 2027.

With the rapid rise in popularity, let's explore what a digital wallet is, types of digital wallets, and digital wallet solutions.

What Is a Digital Wallet?

A digital wallet, also known as an e-wallet, is a software application or online service that stores digital versions of your credit and debit cards, bank account information, and even cryptocurrency. This digital tool enables users to make electronic transactions, manage payments, and store various types of digital currencies or assets. By using smartphones, tablets, or computers, users can access their digital wallets to perform transactions such as online shopping, paying bills, transferring money, or even purchasing goods in physical stores using QR codes or near-field communication (NFC) technology.

Digital wallets allow you to make payments directly from your device, removing the need to carry physical cards. By storing your credit card, debit card, or bank account information, you can easily complete purchases using just your device.

Beyond payment methods, digital wallets can also store a wide range of other items, including Gift cards, Membership cards, Coupons, Event tickets, Airline and transit tickets, Hotel reservations, Driver's licenses, Identification cards, and more.

What Is a White Label Digital Wallet?

A white-label digital wallet is a pre-built, customizable software solution that allows companies to offer digital wallet services under their own brand. It is developed by a third-party provider, but the client company can rebrand it, adjust the user interface (UI), and integrate it with its own systems to suit its needs.

This type of solution typically includes features such as storing payment methods (credit/debit cards, cryptocurrencies, etc.), making transactions, and managing accounts. By opting for a white-label solution, businesses can save time and resources on development and focus on customer acquisition and market positioning. The end-users are not aware of the underlying third-party technology since it’s branded as the company’s own product.

White-label digital wallets are commonly used by financial institutions, fintech companies, e-commerce platforms, and mobile payment services to quickly offer secure and scalable digital wallet functionalities without having to develop the entire platform from scratch.

How To Use Digital Wallet?

A digital wallet can be used to make payments to retailers, as well as transfer money to friends, family, or even yourself.

By adding your bank account or credit card information, you can set up your digital wallet and start using it. Modern digital wallets typically use a tool called "tokenization" to secure card numbers.

However, it's also a good idea to check the security policies of your digital wallet provider and lock your digital wallet app with a password or facial recognition tool (such as Apple's Face ID) to enhance security.

Once your financial information is added to the digital wallet and accepted by the system, you can use the wallet for both online and offline payments.

Looking for Contactless Symbols

Most digital wallets use one of two contactless payment technologies: Near Field Communication (NFC) or Magnetic Secure Transmission (MST). These technologies allow wireless connections and data transfers between mobile devices and contactless card readers at merchants when in close proximity.

You can select the "card" you wish to use for payment in your digital wallet and then hold your mobile device near the reader to start the transaction.

If you have biometric security enabled, you’ll need to unlock your device with your face or fingerprint before proceeding with the transaction.

Using QR Codes

Some merchant point-of-sale applications may use QR codes instead of NFC-enabled payment terminals.

This is especially common in some parts of Asia, where consumers can scan a QR code to view and pay their bills via digital wallets.

To use QR code payments, look for PayPal or other QR code payment options near the cashier.

Sending Money to Friends and Family

If the recipient uses the same digital wallet or a compatible mobile banking app, you might be able to send them money by searching for their username, phone number, or other account details.

In the U.S., friends often "Venmo" each other for their share of expenses, while people in Brazil typically use the Pix payment system for peer-to-peer transfers.

However, digital payments typically only work within a country's banking system, so international money transfers may require apps like Remitly."

Advantages of Digital Wallets

If you live in a country that heavily relies on mobile payments or are planning to travel to such countries, learning how to use a digital wallet is essential. Besides that, using a digital wallet offers the following three advantages:

Security

Carrying credit or debit cards in a physical wallet can be risky. Even if you don't lose or misplace your wallet, thieves may still steal your card information while using an ATM.

Digital wallets reduce the risk of unauthorized card transactions. They securely store payment information, and you can protect card details from hackers through various forms of authentication.

If your phone is stolen, you can remotely disable the wallet, saving you the trouble of canceling physical cards and waiting for a new one to be issued.

Convenience

Using a digital wallet can be more convenient than other payment methods. Depending on the type of digital wallet you use, you might be able to view your balance directly within the app and set reminders and notifications.

If your digital wallet supports international transactions, you don't even have to exchange currency or carry cash.

Additionally, it can be used to store items like boarding passes and concert tickets, so you don't have to worry about leaving important documents at home.

Speed

Digital wallets can usually process transactions more quickly than other payment methods. Checks often take several business days to clear, and credit card payments might not immediately reflect in your account balance.

Digital wallets allow 24/7 transactions, so you don’t have to wait for the bank to open before initiating a payment. Peer-to-peer transactions are also very fast, especially if the recipient uses the same mobile banking service."

What Are The Types Of Digital Wallet?

There are several types of digital wallets, each serving different needs and use cases. The main types are:

1. Closed-Loop Digital Wallets

Definition: These wallets are issued by a specific company and can only be used within its ecosystem.

Examples: Apple Pay, Google Pay (for specific merchants), or loyalty programs from retailers.

Features:

Users can store funds or reward points.

Limited to specific merchants or services within the company’s network.

Often used for loyalty rewards or in-store payments.

2. Semi-Closed-Loop Digital Wallets

Definition: These wallets allow transactions with a specific set of merchants or service providers but are not limited to a single company.

Examples: PayPal, Venmo, or Alipay (used in a variety of retailers, not just one).

Features:

Users can store money and make payments with partnered vendors.

Can be used for a wide range of services but within certain restrictions.

May allow withdrawals to a bank account.

3. Open-Loop Digital Wallets

Definition: These wallets allow users to make transactions at any merchant or business that accepts digital payments.

Examples: Google Pay, Apple Pay, and Samsung Pay (with linked credit/debit cards).

Features:

Users can store a variety of payment methods (credit/debit cards, bank accounts, etc.).

Can be used at any merchant or ATM that supports digital payments.

Open to integration with multiple financial institutions.

4. Cryptocurrency Wallets

Definition: A wallet designed specifically for storing and managing cryptocurrencies such as Bitcoin, Ethereum, and others.

Examples: MetaMask, Trust Wallet, or Ledger hardware wallets.

Features:

Secure storage for digital currencies.

Can be used to send and receive cryptocurrency transactions.

Includes private keys for secure access and transactions.

5. Hybrid Digital Wallets

Definition: These combine features from closed-loop, semi-closed-loop, and open-loop wallets, allowing for more flexibility and functionality.

Examples: Samsung Pay, which allows users to link cards for use anywhere and store loyalty rewards and membership cards.

Features:

Ability to store various types of payment methods.

Can work across a variety of merchants and allow for multiple payment sources.

Offers added features such as loyalty rewards, coupons, and event tickets.

6. Mobile Wallets

Definition: Digital wallets that are primarily used through smartphone apps.

Examples: Apple Pay, Google Pay, Samsung Pay.

Features:

Make payments via NFC (Near-Field Communication) or QR codes.

Store payment methods, loyalty cards, and tickets.

May integrate with other apps for seamless transactions.

7. Web Wallets

Definition: These are digital wallets that can be accessed through a web browser on a computer or mobile device.

Examples: PayPal, Google Pay (web-based access), and certain cryptocurrency wallets.

Features:

Provide easy access to digital funds from any browser-enabled device.

Often linked to a user’s email or mobile number for easy access.

8. Hardware Wallets

Definition: Physical devices that store digital wallet information offline, providing enhanced security.

Examples: Ledger Nano S, Trezor.

Features:

Used primarily for storing cryptocurrencies.

Not connected to the internet, providing strong protection against hacking.

Secure storage for private keys.

Each type of digital wallet serves different purposes, from facilitating simple payments to storing digital currencies securely. They vary in terms of their functionality, the types of transactions they support, and the level of security they provide.

Significance of a Digital Wallet

The significance of a digital wallet lies in its ability to transform the way people manage and use their financial resources in a highly connected, digital-first world. It offers multiple benefits that go beyond simple payments, providing enhanced security, convenience, and greater control over financial transactions. Here are the key points illustrating the importance of digital wallets:

1. Convenient Payment Solutions

Quick and Easy Transactions: Digital wallets simplify the payment process, enabling users to make quick purchases both online and offline using their smartphones or other devices. They eliminate the need for carrying physical cards, cash, or checks.

Multiple Payment Methods: Users can link various payment methods such as debit/credit cards, bank accounts, and even cryptocurrencies, consolidating all their financial information into one accessible platform.

2. Enhanced Security

Reduced Risk of Theft: Unlike physical wallets, digital wallets are less vulnerable to being stolen, as they do not require carrying cash or cards around. Payments are often secured with encryption and biometric authentication (fingerprint, facial recognition).

Tokenization Technology: Digital wallets use tokenization to protect card details, replacing sensitive information with unique tokens, making it difficult for hackers to access financial data.

3. Streamlined Financial Management

Track Spending and Budgeting: Digital wallets often come with features that allow users to track their spending, view transaction history, and set financial goals. This helps in better managing finances and budgeting effectively.

Loyalty and Rewards Integration: Many digital wallets offer the ability to store loyalty cards, rewards points, and coupons, making it easier to redeem benefits and discounts when shopping.

4. Global Accessibility and Travel Benefits

Cross-Border Transactions: With the ability to conduct international transactions, digital wallets help users avoid the hassle of currency exchange when traveling. Some wallets even support multiple currencies and eliminate the need to carry cash while abroad.

Instant Transfers: Digital wallets enable peer-to-peer (P2P) money transfers, allowing users to send money instantly to friends or family without the delays often associated with traditional bank transfers.

5. Contactless and Seamless Experience

Contactless Payments: With NFC (Near Field Communication) technology, digital wallets enable contactless payments by simply tapping a smartphone or device near a payment terminal, providing a faster and hygienic method for completing transactions.

Integration with Other Services: Many digital wallets integrate with various apps and services, including ride-sharing platforms, online shopping, ticketing systems, and more, making them versatile tools in everyday life.

6. Future-Proof and Innovative Technology

Cryptocurrency Support: Some digital wallets support cryptocurrency transactions, enabling users to buy, sell, or store digital currencies. This reflects the growing importance of blockchain and decentralized finance (DeFi) in the financial ecosystem.

Continual Innovation: As technology advances, digital wallets continue to evolve, adding features like AI-powered financial insights, biometric security improvements, and seamless integrations with emerging technologies.

Overall, the significance of a digital wallet goes beyond just facilitating payments—it enhances security, offers ease of use, supports financial management, and provides a more efficient and sustainable way of handling money in today's fast-paced, digital world.

Examples of Digital Wallets

There are several popular digital wallets that cater to different types of users, each offering unique features and functionality. Below are some examples of widely used digital wallets:

1. Apple Pay

Platform: iOS (iPhone, iPad, Apple Watch, Mac)

Features:

Supports credit and debit card payments, as well as peer-to-peer transactions.

Uses NFC technology for contactless payments.

Integrated with Apple services like iMessage for sending money to friends.

Allows users to store loyalty cards, tickets, and boarding passes.

Strong security features such as Face ID, Touch ID, and tokenization.

2. Google Pay

Platform: Android, Web

Features:

Supports credit and debit card payments, as well as P2P payments via Google Pay Send.

Integrates with Gmail to facilitate quick bill payments and other transactions.

Stores loyalty cards, gift cards, tickets, and more.

Works across a wide range of Android devices and integrates with Google services.

Offers security features such as multi-factor authentication and tokenization.

3. PayPal

Platform: Web, iOS, Android

Features:

Popular for online payments, P2P transfers, and purchases on various e-commerce platforms.

Can link multiple bank accounts, credit cards, and debit cards.

Allows international transactions, supporting multiple currencies.

Supports digital invoicing for businesses.

Security features include buyer protection, fraud detection, and encryption.

4. Samsung Pay

Platform: Android (Samsung devices)

Features:

Works with NFC and MST (Magnetic Secure Transmission) for contactless payments, allowing it to be used on traditional magnetic stripe terminals.

Can store and use credit/debit cards, gift cards, and loyalty cards.

Security features include Samsung Knox, fingerprint recognition, and tokenization.

5. Venmo

Platform: iOS, Android

Features:

Primarily used for P2P (peer-to-peer) transfers within the U.S.

Allows users to send and receive money via linked bank accounts, credit/debit cards, or Venmo balance.

Popular for splitting bills and paying friends for various services.

Allows transactions with a social feed, where users can share payment notes.

Owned by PayPal, ensuring high levels of security.

6. Alipay

Platform: iOS, Android

Features:

Popular in China and internationally, primarily for mobile payments and e-commerce.

Allows users to pay for goods and services, transfer money, pay bills, and top-up mobile phones.

Supports QR code-based payments, allowing for easy transactions in physical stores.

Offers services like investment management and insurance.

Strong security with features like facial recognition and PIN protection.

7. WeChat Pay

Platform: iOS, Android

Features:

Integrated within the WeChat app, allowing users to make payments for goods, services, and P2P transfers.

Used widely in China for everything from shopping and dining to paying bills and booking services.

QR code payments are a common feature.

Integrated with other WeChat features, like sending red envelopes (a Chinese tradition).

Security includes facial recognition and fingerprint ID.

8. Cash App

Platform: iOS, Android

Features:

Offers P2P transfers, allowing users to send money to friends and family.

Users can buy and sell Bitcoin directly through the app.

Includes a physical Cash Card linked to the Cash App balance for in-store purchases.

Allows users to receive direct deposits and manage finances through the app.

Provides security with PIN protection and multi-factor authentication.

9. Amazon Pay

Platform: Web, iOS, Android

Features:

Allows users to pay for goods and services on third-party websites using their Amazon account details.

Supports credit/debit card payments, Amazon balance, and stored gift cards.

Integrates seamlessly with Amazon’s online shopping platform.

Offers security with Amazon’s robust fraud protection and encryption.

10. Paytm

Platform: iOS, Android

Features:

One of the most popular mobile wallets in India, used for bill payments, mobile recharges, and P2P transfers.

Users can store bank account details, credit/debit card information, and rewards points.

Offers features like ticket booking, shopping, and even investment in gold.

Security features include PIN protection, OTP verification, and encryption.

11. Crypto Wallets (e.g., MetaMask, Trust Wallet)

Platform: iOS, Android, Web (for browser extensions)

Features:

Primarily used for storing and managing cryptocurrencies like Bitcoin, Ethereum, and other altcoins.

Allows users to send, receive, and store digital assets securely.

Some wallets support decentralized applications (dApps) and non-fungible tokens (NFTs).

Security relies on private keys and backup phrases, ensuring that only the wallet owner can access their funds.

12. Luno

Platform: iOS, Android, Web

Features:

Digital wallet for storing and trading cryptocurrencies.

Supports popular cryptocurrencies such as Bitcoin, Ethereum, and Ripple.

Allows users to buy, sell, and exchange digital currencies.

Security includes two-factor authentication and encrypted data storage.

Each of these digital wallets serves different needs—some are designed for everyday payments, others are focused on cryptocurrency management or international transfers. They all share the goal of streamlining financial transactions while enhancing security, convenience, and speed for their users.

How To Select A Trustworthy White-Label Digital Wallet Solution Provider?

When you decide to implement a white-label wallet app, it’s crucial to find a skilled technical partner who can provide a high-quality solution. Since digital wallets must adhere to strict security standards and complex regulations, working with top development experts is essential to protect user funds and data from potential threats. Here are key factors to consider when selecting a wallet developer:

Customization and Branding

Full Customization Options: A good white-label provider should offer the ability to fully customize the wallet’s branding, including logos, colors, user interface (UI), and messaging, ensuring a seamless fit with your business identity.

Feature Flexibility: Ensure the provider offers customizable features such as loyalty programs, transaction categorization, and notifications, so the wallet can be tailored to your specific needs.

White-Label Solution: The provider should offer a true white-label solution, meaning there should be no traces of the provider’s branding within the app or interface when you launch it to your users.

Security & Compliance

Ensure the provider uses strong encryption, tokenization, and complies with PCI-DSS, GDPR, and AML/KYC standards to protect user data.

Look for fraud prevention tools like real-time monitoring and multi-factor authentication (MFA).

Reputation and Experience

Industry Reputation: Research the provider’s track record and client base. Look for reviews, case studies, and testimonials to assess their experience and reliability.

Past Successes: Investigate the provider’s success stories, particularly in implementing white-label wallet solutions for businesses similar to yours.

References: Ask for references or contact businesses that have used their solution to understand the provider’s reliability, customer support, and overall performance.

Security Features

Multi-Factor Authentication (MFA): Ensure the solution includes MFA, such as fingerprint recognition, facial recognition, or one-time passcodes (OTPs), to secure user accounts.

Biometric Verification: The wallet should support biometric authentication (e.g., Face ID, fingerprint recognition) to improve security and user experience.

Payment Gateway Security: Ensure the wallet is integrated with secure payment gateways that comply with global security standards for handling card payments.

User Experience and Interface Design

Intuitive UI/UX: The digital wallet should provide an intuitive user interface (UI) and seamless user experience (UX). The app should be easy to navigate, enabling users to make payments, transfers, and view balances effortlessly.

Mobile Optimization: The provider should offer a mobile-first wallet solution that is optimized for iOS and Android devices. Ensure the solution supports all mobile devices and offers responsive designs.

Transaction Speed: Digital wallets should process transactions quickly. Ensure that the provider’s solution can handle fast payments, transfers, and top-ups without delays.

Cost and Pricing Structure

Transparent Pricing: Choose a provider that offers clear, transparent pricing without hidden fees. Understand the total cost, including setup, maintenance, transaction fees, and any other charges.

Flexible Payment Plans: The pricing structure should be flexible, such as pay-per-transaction, subscription-based pricing, or tiered models based on the volume of transactions.

Long-Term Value: Prioritize long-term value over short-term cost savings. A higher upfront investment in a reliable, scalable, and secure solution may save you money and resources in the long run.

Integration and APIs

API Access: The provider should offer comprehensive APIs and SDKs to integrate the digital wallet with your existing systems, including payment gateways, CRMs, and customer support platforms.

Third-Party Integrations: Ensure the wallet can integrate with other services such as payment processors, banking systems, loyalty programs, and cryptocurrency exchanges if needed.

Cross-Platform Compatibility

The wallet should be accessible across multiple devices and operating systems, including Android, iOS, macOS, and web platforms. Make sure the provider guarantees seamless compatibility across these environments."

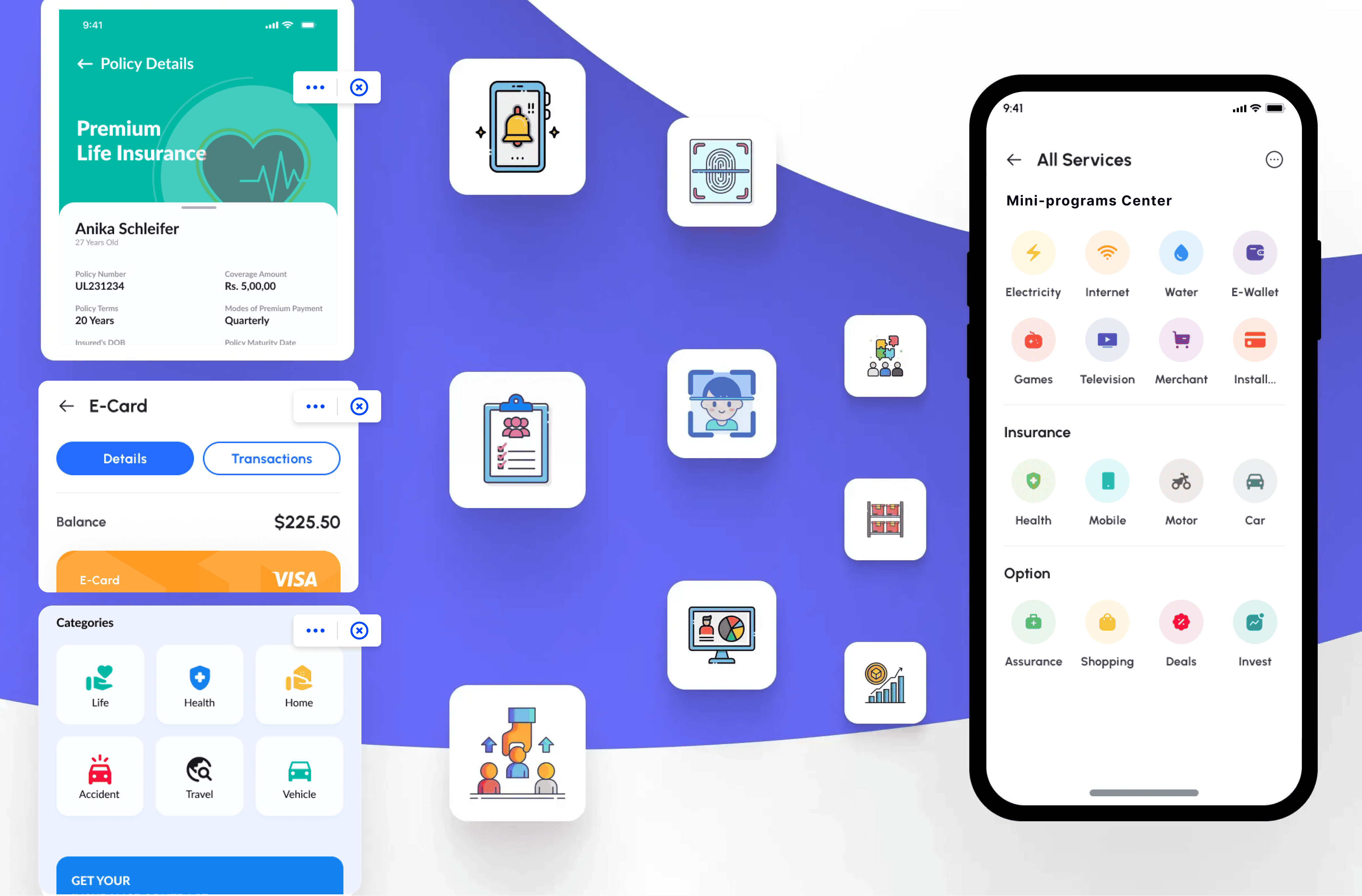

FinClip: The Ultimate Solution for Turning Digital Wallets into Super Wallets

FinClip provides a powerful and flexible solution for transforming a digital wallet into a super wallet by offering extensive open capabilities. With the FinClip miniapps container, digital wallet apps can integrate third-party mini-programs into their platform, expanding business scenarios and enhancing user engagement. This allows wallets to evolve from simple payment tools into comprehensive ecosystems that offer a wide range of services, all within a single app.

FinClip’s Solution

Enriching Business Scenarios: By integrating the FinClip SDK, digital wallets can offer a variety of mini-program services like shopping, ride-hailing, and social media, all within the same app. This integration allows users to make payments seamlessly while engaging in multiple tasks, without needing to switch apps.

Rapid Third-Party Integration: FinClip makes it easy to integrate mini-programs from third-party partners. This rapid integration enables wallets to create unique financial services, enhancing user engagement and expanding usage scenarios, while maintaining a standardized process for onboarding new partners.

Offline Merchant Integration: With FinClip, digital wallets can connect online and offline services. For example, users can scan QR codes at a restaurant, access the ordering mini-program, and make payments all within the wallet app, bridging the gap between online and offline experiences.

Key Technical Advantages

Cross-Platform SDKs: FinClip’s SDK is compatible with iOS, Android, Linux, Windows, and macOS, allowing seamless integration of mini-programs across multiple platforms.

Secure Sandbox Containers: FinClip ensures that mini-programs run in isolated, secure environments within the app, providing a safe and controlled execution of third-party content.

High-Performance Engine: The customized JavaScript engine provides fast, responsive rendering of mini-programs, rivaling the performance of native apps, with multi-threading and aggressive caching techniques for enhanced speed.

Why Choose FinClip?

FinClip is the ideal solution for digital wallet providers looking to expand beyond simple payments. It empowers wallets to deliver a broad range of services, integrate seamlessly with third-party programs, and improve user engagement across both online and offline experiences. With its robust technical infrastructure, FinClip transforms digital wallets into true super wallets, ready to meet the demands of the evolving digital economy."