Rise of Social E-commerce Overseas: Mini Programs Facilitating the Creation of Super Apps

In recent years, social e-commerce has been a lively topic. With the decline of the Internet e-commerce traffic dividend and the slowing growth of traditional e-commerce, a rapidly emerging group of social e-commerce platforms, represented by Xiaohongshu, TikTok, and Kuaishou, has taken the lead in China. Following closely, the wave of Chinese social e-commerce has driven the global development of social e-commerce.

In the joint report "2022 Social Media Trends" released by HubSpot and Talkwalker, several noteworthy trends in overseas social media are highlighted:

1、TikTok's Ascendance: TikTok has shattered overseas application download records, becoming the first non-Facebook app to surpass 3 billion global downloads.

2、Global Addition of Social Media Users Surpasses 500 Million, a nearly 14% year-on-year increase. The pandemic has undeniably heightened social media usage worldwide.

3、The Era of Mature Influencer Marketing Has Arrived. According to Influencer Marketing Hub's 2021 research report, 67% of respondents engage in influencer marketing using Instagram.

In summary, social networks are witnessing the emergence of new platforms, new user growth opportunities, and innovative approaches to social marketing.

The development of overseas social e-commerce: challenges and opportunities coexisting

It must be acknowledged that, within a public opinion and consumption market environment different from China's, the development of overseas social e-commerce enterprises faces both challenges and opportunities.”

Challenges: Traditional e-commerce and social media platforms are actively seeking new opportunities for digital transformation.

According to a 2021 survey by the U.S. social platform Sprout Social on the social e-commerce behavior of over a thousand consumers, findings include:

In 2021, 68% of consumers engaged in purchasing behavior on social media, with this proportion continually increasing.

Consumers are predominantly shifting towards major social commerce applications such as Facebook Shops, Instagram Shopping, and TikTok Shopping.

Despite an overall economic downturn overseas, the trend in social e-commerce shows no signs of slowing down. In 2022, 98% of consumers plan to make at least one purchase through social e-commerce or influencer e-commerce.

Major social platforms are making preparations and attempts to transform amidst the overall trends of the pandemic and changing consumption patterns. Some localized social platforms, lacking in technological strength themselves, are considering deep integration with traditional e-commerce SaaS platforms such as Shopify, Bigcommerce, and WowCommerce to quickly adapt to the changing demands of the market users. Specializing in their own expertise and collaborating with upstream and downstream ecosystem enterprises is equivalent to a race against the market, aiming to quickly capture the minds of users.

Opportunities: The significant loyalty of users to brands should not be underestimated

Unlike domestic consumers who prefer completing the consumption loop on one or a few apps, most overseas consumers are accustomed to making purchases on the official websites of brands. This is one of the reasons why overseas DTC e-commerce has rapidly grown.

To illustrate further:

According to the "U.S. Top Social Platforms Consumer Shopping Trust Survey" released by Insider Intelligence in 2021, users' attitudes towards directly purchasing products on Facebook are polarized: 45% of respondents said they would directly purchase products on Facebook, 35% said they would not, and 20% held a neutral attitude towards Facebook's e-commerce.

Overseas marketing media Eventige stated in a blog post that 50% of millennials (those born between 1980 and 1995) would search for product information online and on social media, and then make purchases in physical stores. Overseas users have higher brand recognition and loyalty, providing a favorable opportunity for digital transformation for overseas brand businesses in the market."

To Pursue Traffic or to Retain Volume?

In an era of fragmented information reception and exponential growth in content, social media has addressed the issue of users' unrestricted access to information, ultimately becoming the mainstream arena for user engagement. This is also commonly referred to as the 'traffic battleground' or 'public domain traffic pool.'

During the explosive growth phase of social media, many brands joined forces with these platforms to promote their products and brand to a broader audience. However, for enterprises, this also means the need for an additional team to manage multiple social media platforms, creating content and topics that 'cater' to consumers according to the tone of each platform.

Over time, the 'traffic' remains on the platform and cannot be fully retained by the brand. The activity of brand-owned spaces gradually declines, and simultaneously, business owners must cope with the rising costs of platform advertising.

Perhaps, with the development of social e-commerce, there is an excellent opportunity for brands and local life platforms to reconsider the importance of retaining users, shifting the focus from 'traffic' to 'volume.'"

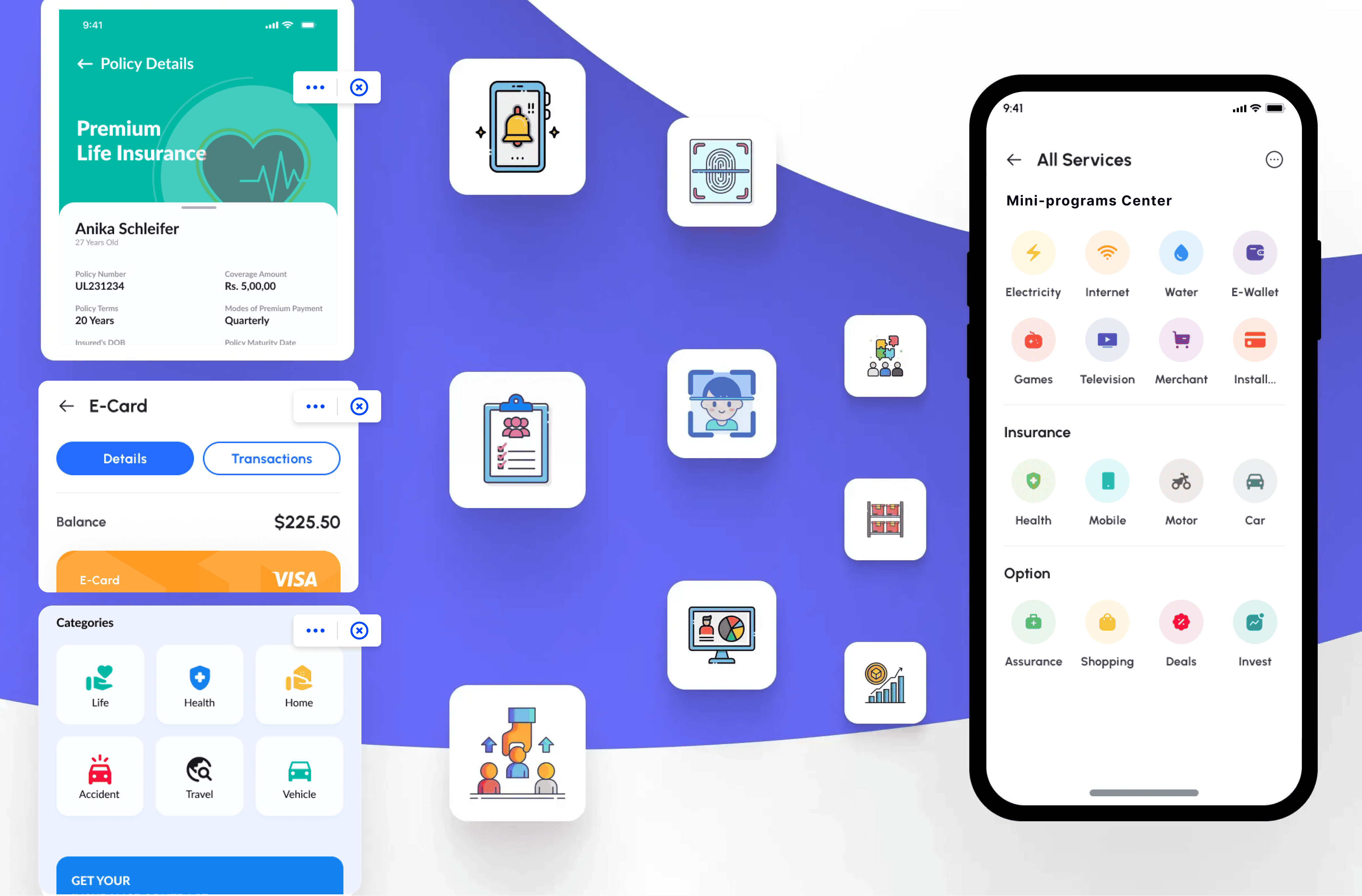

Mini-programs is a superior digital content carrier

People often say that in the era of social media, victory lies in content and experience.

In the era of graphic and textual content, if there is a need to rapidly present content to users, the best technological platform is the HTML5 web page. Content needs to be published only once and can be displayed across major social media platforms.

In the era of short videos, H5 technology falls short in comparison to mini-programs when it comes to processing and displaying videos. Mini-programs run their code directly on the app, utilizing technologies such as dual-thread UI rendering through the browser and separating business logic, resulting in a smoother experience compared to H5. Aside from the initial loading time of a few seconds upon opening, the transitions and navigation between different pages in a mini-program rival those of native apps, providing an equally silky-smooth effect.

This is one of the reasons why major traffic platforms such as WeChat, Alipay, and Douyin have started to create their own open mini-program technology platforms.

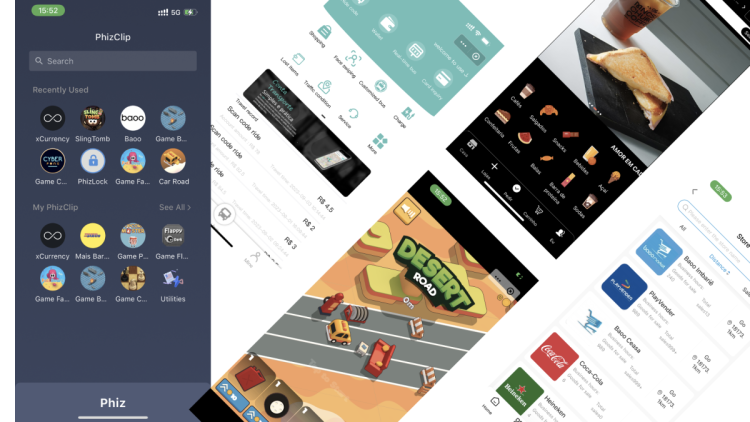

Phiz Chat: The Brazilian Version of WeChat, Mini-Program Ecosystem Boosts Social Circle Activity

Phiz (developed by PHIZ APP LTDA) aims to create the Brazilian version of WeChat. Since its launch, in addition to basic social chat functions, Phiz also aims to quickly introduce local lifestyle and online entertainment applications in Brazil to further enhance user social engagement on the Phiz platform.

The choice of integrating FinClip, an embedded mini-program secure sandbox developed by Fantai Geek, is because FinClip can help Phiz obtain a large amount of content and resources on the supply side through support for the standard mini-program format, thereby building a digital content ecosystem.

Simplify complexity and enable agile modular application development. Leveraging FinClip's mini-program container technology to break down bulky app features, decoupling functional modules (e.g., Phiz Ride) to achieve modular development. Business modules do not interfere with each other, and dynamic updates and releases can be achieved through the management backend, greatly improving development efficiency and reducing costs.

Support personalized user content delivery. Leveraging FinClip's mini-program gray release and A/B testing capabilities, existing business applications can be precisely delivered to target audiences, easily achieving intelligent recommendations for marketing activities and business functions.

Rapid integration of third-party service ecosystems. With FinClip's mini-program management platform, Phiz can quickly and extensively introduce digital scenario partners. Utilizing mature mini-program application services from platform users of these partners helps address the platform's user stickiness issue."

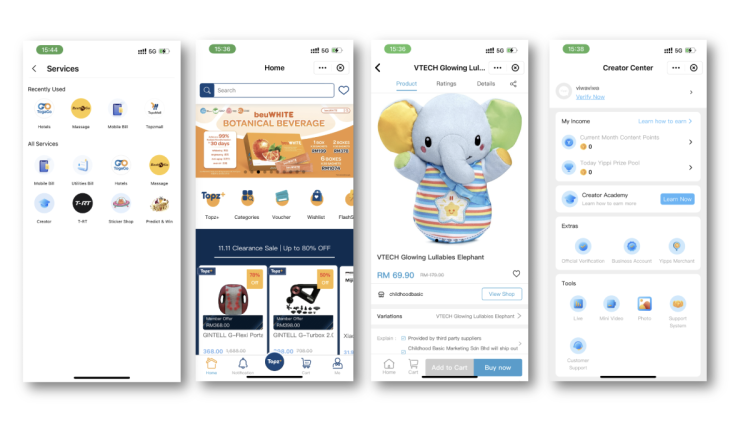

YIPPI: Malaysia's Super App in the Social E-commerce Sector

Yippi is a Southeast Asian mobile communication and social media platform. Yippi aims to become one of the largest super apps in Southeast Asia, with content at its core. It expands its user base by providing a creative platform for creators in various industries, including content creation such as graphics, videos, and live streaming. Simultaneously, Yippi actively explores collaborations with third-party service providers to offer its user base a comprehensive range of lifestyle services.

In essence, whether it's a super app or social e-commerce, both are means to retain users. A phrase commonly heard in recent years is, 'The fundamental development of social media is the establishment of a 'content barrier.'' The so-called content barrier goes beyond visible content creation and includes diversified functionalities that meet user needs, as well as operations that users can complete without leaving the application—meaning, the users are truly staying.