Super App for Financial Services

Superapp (or“超级App”in Chinese) has recently been making waves. At this week's Hong Kong Tech Week 2022 (from October 31 to November 4, 2022), a special roundtable discussion on superapps was organized on the first day, likely marking the first serious discussion on this concept in the financial industry. FunTech Geek, an online exhibitor specializing in this technology category, is certainly paying close attention.

Before sharing relevant content from this forum, let's first explain to friends unfamiliar with this technology how the superapps, which are commonplace in the domestic market, have become one of Gartner's top 10 strategic technology trends for 2023 and have already started impacting the financial industry.

The phenomenon of superapps on the Chinese internet has not gone unnoticed internationally, but it only became a hot topic this year. This can be credited, to some extent, to Elon Musk.

Elon Musk's X App

Musk has not been shy about expressing his admiration for certain phenomenally successful super social platforms in China. Even before acquiring Twitter, he frequently mentioned that he wanted to create a similar "X App," or "Everything App," which would offer users one-stop access to services related to living, information and news, consumer spending, and entertainment. By establishing a vast and prosperous digital ecosystem, consumers would receive excellent service experiences and immense convenience.

After successfully acquiring Twitter, this grand plan became more feasible. Musk once stated that one of his reasons for acquiring Twitter was to transform it and pave the way for the "X App."

Frankly speaking, the content interaction experience on the overseas internet is relatively poor, and this is one of the points Musk himself has complained about. Information content is embedded in web pages interspersed with various floating ads and pop-ups, which are especially annoying on mobile internet, resulting in a dreadful user experience. Even news aggregation apps typically just scrape web content, filter it based on user preferences, and organize it through some interfaces, presenting a few "tiles" to the user. When opened, they're still filled with various unrelated ads that ruin the experience. At times, it feels like being in the Web 1.0 era of the 90s.

Although smartphone apps became widespread in the mobile internet era, offering a better human-computer interaction experience than web pages and more suited for thumb operations in that small handheld space, from an open perspective, apps are a form of backlash against an open internet. Each app is like a black box, an information island, difficult to connect with others and thereby hard to produce network effects. In an age where connectivity is crucial, it may not even be the best form of digital content.

The emergence of superapps seems very natural. Internet giants need to maintain a certain degree of openness to achieve interconnection while also requiring centralized and controlled management and operation. It can be said that this is still a balance and compromise between "centralization" and "distributed operation."

As apps, they are obviously not as open as "browser + web page," but neither are they as closed as ordinary apps. They are semi-open digital ecosystems—anyone can "enter" the platform, but the content and services provided are clearly subject to platform regulation.

Superapps are especially valuable in the digital age because they redefine the digital boundaries between enterprises.

Gartner on the 2023 Top 10 Strategic Technology Trends

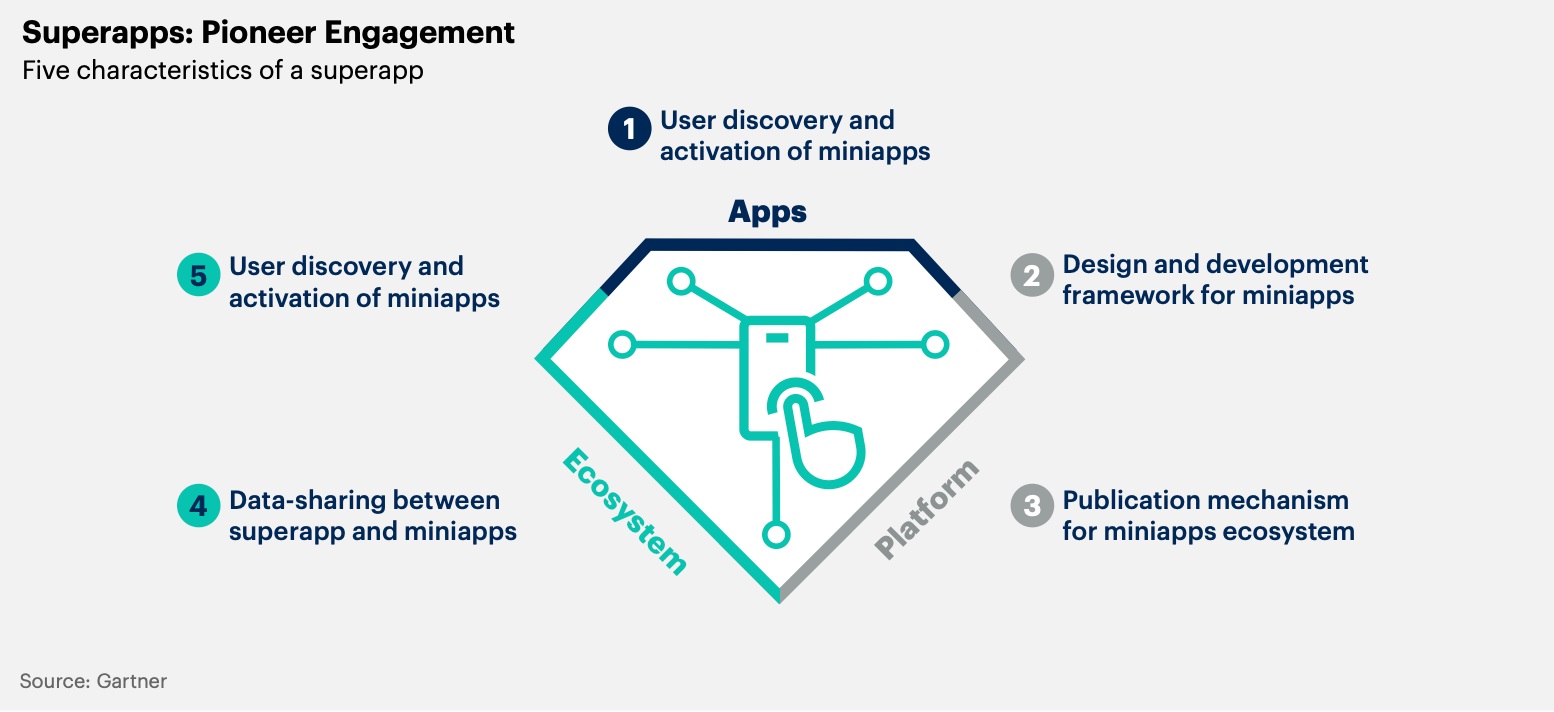

In Gartner's 2022 top 10 strategic technology trends, "composable applications" were mentioned. But in its 2023 trend report, the term "composable" seems to have disappeared, seemingly replaced by "superapps." According to Gartner, "Superapps are applications that combine the features of an app, a platform, and an ecosystem in one. They not only have their own set of functions but also provide a platform for third parties to develop and publish their own micro-apps." Gartner predicts that by 2027, over 50% of the global population will be daily active users of multiple superapps.

As a team that has been investing in related technological research and development since 2019, our understanding has some similarities with the above picture. However, we also have our own independent perspective formed through practice.

Superapps Assembled from "Miniapps"

Superapps naturally contain unlimited, massive content. But what is the carrier of this content? It's a lightweight technical form of some format (referred to as miniapps in Gartner's article). Although there are different potential technical carriers to achieve this effect, such as some major enterprises inventing their own specifications and formats, self-invented and non-standard things generally lack vitality, especially considering that content providers are third-party and external partners—this involves their development costs and willingness to support.

The "miniapp" format we favor is small programs—a technical form already familiar to Chinese users and currently being standardized by the International Technical Standards Organization W3C. Its benefits are that it has been validated by major internet platforms, contains abundant existing content, and has a deep pool of development talent.

For an app to become "super," it needs to adopt standardized and open technologies to attract a large number of content partners. On domestic internet platforms, there are often millions of small programs. This scale effect not only challenges platform operation capabilities but also necessitates technological standardization, regulation, and openness.

Focusing on Lifecycle Management of Digital Interactive Dynamic Content Assets

Miniapps or small programs can be understood as digital content assets containing the code, data, text, and multimedia content involved in a company's public services. Unlike traditional static content, they are interactive, dynamic, and have the form of application software.

On the content supply side, superapps serve as a digital content asset publishing management platform, while the merchants/enterprise partners on the platform function as "publishers" responsible for creating and publishing their digital content. The superapp owner holds the distribution rights for these published contents. In this regard, our technology aligns with Gartner's "Publication mechanism for miniapps ecosystem."

On the content consumption side, superapps provide consumers with mechanisms to discover these digital content assets, through search engines, recommendation algorithms, displays, and rankings, for example. If we understand superapps as a virtual shopping center, the merchants within are responsible for producing and supplying their digital content, while the superapp provides advertisement displays at the "entrance" about these goods and "navigation" to find these merchants' stores.

Four "Rights" of Digital Content Assets Unified and Separated

From the perspective of digital content assets, we further believe that these miniapps/small programs (codified digital services and business scenarios) within superapps should involve four kinds of rights:

Publishing Rights

These contents often involve specific business logic and intellectual property—who they belong to

Distribution Rights (or Publication Rights)

Control over the availability and shelving of these contents—who holds this power

Circulation Rights

Transferring and sharing these contents among users, and spreading between superapps and other apps

Usage Rights

Authorization for users to utilize these contents

In a platform model, multiple parties are often involved. Not all rights are monopolized by one party. Superapps clearly serve as the crucial carrier for separating and unifying these rights. For enterprises using public small program platforms and becoming part of someone else's ecosystem, what are the ownership rights of the above? In the digital era, how should enterprises reestablish and take control of their own rights?

Making Enterprise Software "Superappified"

Owning a superapp means owning a digital ecosystem and having the power to control the content provided by the ecosystem members. In the past, only internet giants possessed (1) the underlying technology to support superapps, (2) the ability to operate digital ecosystems, and (3) the traffic advantage.

However, for most vertical industry enterprises, "traffic" and "mass users" metrics do not apply. Does this mean that ordinary enterprises are not qualified to build their "super" apps?

Firstly, what counts as "super"? If your understanding is that only internet apps with huge user traffic qualify as superapps, we cannot agree with that view. We believe that to achieve "super," the following characteristics are necessary:

The app should break through corporate boundaries; the content within does not necessarily come from your IT development but primarily from partners or even any developer. You can leverage others to collaboratively serve users

The app should form its own technical ecosystem, providing certain technical interfaces, specifications, and standards so that any organization or individual can develop content based on them. This is similar to the relationship between Apple's App Store and its millions of developers,

The app should support numerous third-party functions and content. It's not difficult to support a certain number of "plugins" to enhance your capabilities and value with external help (well-designed traditional enterprise software can also have such technology). The challenging part is that your app must support an "unlimited" number of such "plugins." It should address the trust, security, privacy protection, and management issues between you and your plugin providers. Scalability in this aspect is an important indicator of whether your app is "super".

We believe that the above characteristics are necessary for any enterprise in the digital age. Any enterprise undergoing digital transformation needs to solve the balance between openness and security control. Because digitalization implies connectivity, and connectivity is based on openness, the prerequisite for openness is security control. The form of superapps is the unification of centralization and decentralization, control, and openness.

The software form of superapps is accessible and utilizable for ordinary enterprises, and their platform operation capability can be built with the support of technical platforms. Creating your own superapp is essentially building your own digital platform and ecosystem, making these aspects perceptible and practically usable through the app.

The Future of Digital Wallets: From Digital Payments to Superapps

This was the title of a roundtable discussion at this year's Hong Kong Fintech Week.

Digital wallets have evolved into "infrastructure" of the internet in the Web 2.0 world. Initially, they were the basic infrastructure for e-commerce and online consumption. Subsequently, they also became the standard facility for offline consumption in many regions. In economically underdeveloped regions with low banking coverage, mobile digital wallets have even replaced banks, providing financial services to unbanked populations and achieving financial inclusion. In the Web 3.0 world, digital wallets can be considered the "cornerstone" of the digital world—they are part of the internet. Internet users acquiring online digital services no longer visit a website or an app and undergo login authentication but dynamically download digital content (such as miniapps) and then authorize their digital wallets to grant partial data access to enable services.

Whether in the Web 2.0 or Web 3.0 world, digital wallets are the most crucial connecting tool, linking consumers on one side and merchants providing online and offline goods and services on the other, naturally possessing the characteristics of multi-sided platforms and ecosystems. It is logical for them to develop into superapps.

The roundtable discussion generated the following points from forum guests (which may not be new for the domestic market that started early).

Digital wallets appearing in the form of superapps will revolve around the cycle of browsing, consumption, lending, and collection. Superapps aggregate a large amount of content (such as miniapped products and services) provided by merchants themselves and allow consumers to discover this content through mechanisms like display, ranking, search, recommendations, and sharing. They then browse and securely and conveniently make payments via the digital wallet. When paying, the platform provides necessary credit, allowing consumers to obtain loans. Subsequently, the platform behind the superapp focuses on risk control and reducing bad debts.

Superapps help track consumers' digital footprints. This can create a flywheel effect: the richer the content provided in the app, the more frequently it is used, and the more the platform understands the user.

Evaluating user behaviors, preferences, and risks—the core application product behind this is Credit. This essentially involves building and using data means to assess users' creditworthiness.

In a high-interest, high-inflation environment, the market demands BNPL (Buy Now Pay Later). This concept leverages credit and risk control to offer "zero-cost" purchases. The BNPL trend is popular overseas, including in the Hong Kong market, and involves guiding consumers' rational consumption; regulation is an inevitable trend.

Superapps have applications in Embedded Finance, Embedded Insurance, and Embedded Saving. The market size prediction for embedded finance in the next decade is $7 trillion. Who embeds whom? Digital wallets as superapps integrate the consumption scenarios of their ecosystem partners to play their payment role. Financial institutions embedding their financial services into others' superapps is another form of integration. In embedding, there is mutual inclusion.

The journey of digital wallets + superapps abroad has just begun.

FinTech's Next Frontier?

At a session titled "FinTech's Next Frontier" during Hong Kong Fintech Week, Alex Rampell, a partner at the renowned Silicon Valley investment firm Andreessen Horowitz, stated that despite technological innovations, there is still significant room for optimizing financial services. The efficiency and user experience of financial services lag far behind the capabilities of technology. One example: people can send photos to each other thousands of kilometers away instantly. When will financial services achieve the efficiency of sending photos for remittances? The optimization of compliance, risk control, and anti-money laundering in these processes remains very long. Another example: every app on an iPhone informs the user about the data it needs to access and asks for permission when running for the first time. For customers applying for loans or opening accounts, when will a similar mechanism be realized, with financial services requesting access to user device data and using it to automatically (in real time) authorize and approve the data?

The frontier of FinTech may always be chasing after technological advancements—where technology goes, financial services follow and utilize it.

Using superapps as an example, their advantage lies in: merging between website content and apps, establishing a balance between centralized and distributed modes, transforming business IT development into the release of "interactive dynamic digital content," facilitating embedded financial services where digital content assets' publication, distribution, movement, and usage rights promote mutual integration, supporting a high volume of concurrent content production, and managing a vast content ecosystem. Is it time for traditional financial institutions to consider using such technology to build their own digital ecosystems, rather than just being participants in others' ecosystems?