The Evolution and Impact of Open Banking

In recent years, the concept of Open Banking has been transforming the financial landscape worldwide. It represents a significant shift in how banks and financial institutions operate and interact with their customers, driven by technological advancements and changing consumer expectations. At its core, Open Banking revolves around the idea of securely sharing financial data with third-party providers through the use of Application Programming Interfaces (APIs). This enables customers to have more control over their financial information and to access a wider range of financial services and products.

What is Open Banking?

Open Banking refers to the practice of banks opening up their data to third-party developers and financial technology companies, securely and with customer consent. This data sharing is facilitated through APIs, which act as bridges between different software applications, allowing them to communicate and exchange information.

In other words: It enables entities outside of traditional banking institutions to provide banking services.

The key principles of Open Banking include transparency, security, and customer control. Transparency ensures that customers are fully informed about what data is being shared and for what purposes. Security measures such as encryption and authentication protocols are crucial to protect sensitive financial information. Importantly, customers retain control over their data, deciding which third parties can access it and for how long.

Open Banking in the Era of Distributed Commerce: Transforming Financial Services

In the era of the Internet, there has been a profound shift in how users access services, moving from traditional offline channels to online platforms. This transformation has integrated financial services into various digital contexts. Unlike internet companies, which excel at customer acquisition, banks have seen their once dominant physical branch advantage diminish, resulting in less frequent customer interactions. In response to these changes, the banking sector faces an urgent need for transformation. The question remains: where lies the key to breaking through?

Historically, commercial entities have operated predominantly under a centralized management and operation model, spanning from large factories to individual merchants, until the gradual emergence of chain operations in the 1950s. Super chain enterprises like McDonald's, KFC, Walmart, and Carrefour pioneered distributed operations and sales, reducing centralization. Over the past decade, the shared economy has risen as a mainstream model, integrating services such as ride-sharing and shared rentals into daily life, alongside distributed terminal service capabilities. However, platform operators' control over traffic entry points has led to new concentrations of resources, leaving small and medium-sized enterprises at the bottom of the discourse power and industrial chain.

The ongoing accumulation of massive data and the maturation of technologies such as artificial intelligence, cloud computing, and blockchain have fostered increased cross-industry collaboration among enterprises. This trend has catalyzed the emergence of distributed commerce—a new business model characterized by multiple ownership of production means, collaborative construction of product and service capabilities, equitable business relationships, and transparent rules for product and profit distribution. Within this evolving landscape, banks are poised to seize new opportunities for development.

Banking remains a sector with high barriers to entry due to factors like licenses, capital, and resources. Nevertheless, banks possess crucial capabilities—such as deposit and loan services, clearing and settlement functions, robust risk management, banking systems, and KYC expertise—that deliver substantial and irreplaceable value across diverse industries. Imagine if banks, alongside financial institutions, internet giants, and physical industry players, could leverage these strengths within a distributed business model. By playing complementary roles and collaborating effectively, they could not only benefit themselves but also provide ubiquitous banking services to a broad spectrum of users, transforming the accessibility and delivery of financial services worldwide.

The Benefits of Open Banking

The benefits of Open Banking have revolutionized the financial landscape, offering a multitude of advantages that extend beyond traditional banking services. Initially, it allowed non-banking entities to enter the market, introducing user-friendly designs and streamlined processes that emphasize speed, affordability, and convenience. These solutions quickly began competing with traditional bank offerings. However, the impact of Open Banking goes beyond competition:

Holistic Financial Insights: Open Banking consolidates all financial accounts into one platform, providing users with a comprehensive view of their finances. This enables better budgeting, smarter purchasing decisions, and access to tailored products and services that suit individual needs.

Enhanced Customer Experience: Open Banking enables personalized financial services tailored to individual needs and preferences. Customers can access consolidated financial information from multiple accounts and institutions through third-party apps, providing a comprehensive view of their finances.

Increased Choice and Competition: By allowing third-party providers access to banking data via secure APIs, Open Banking fosters competition. This competition drives innovation in financial products and services, leading to better offerings and pricing for consumers.

Improved Access to Financial Services: Open Banking promotes financial inclusion by making it easier for individuals and businesses to access a wider range of financial products, especially those traditionally underserved by banks. This includes better loan options, investment opportunities, and tailored financial advice.

Empowerment and Control: Customers have greater control over their financial data. They can choose to share specific information with trusted third parties, enhancing transparency and ensuring data security through consent-based sharing.

Streamlined Processes: Open Banking simplifies financial processes such as loan applications, account management, and payments. By integrating different financial services into unified platforms, it reduces administrative burdens and enhances efficiency for both consumers and businesses.

Innovation and Collaboration: Financial institutions and fintech companies collaborate more effectively under Open Banking frameworks. This collaboration sparks innovation in digital banking solutions, cybersecurity measures, and customer-centric services.

Data-Driven Insights: Open Banking enables advanced analytics and insights derived from aggregated customer data. Financial institutions can offer personalized recommendations and predictive services, improving financial planning and decision-making for consumers.

Regulatory Compliance: Open Banking frameworks often include robust security and data protection measures, ensuring compliance with regulatory standards such as GDPR in Europe or PSD2 requirements. This enhances consumer trust and safeguards against data breaches.

Cost Efficiency: Open Banking can reduce costs associated with traditional banking operations. By leveraging shared infrastructure and digital platforms, financial institutions can optimize resource allocation and focus on value-added services.

Global Standardization: As Open Banking gains traction globally, it promotes standardization of API protocols and data sharing practices across jurisdictions. This standardization facilitates interoperability and seamless integration of financial services on a global scale.

These benefits initially gained recognition gradually but have now become integral to daily life worldwide, seamlessly integrated into everyday routines without users necessarily realizing their origins in Open Banking. These innovations have become indispensable tools, shaping how people manage their finances and interact with financial services today.

Exploring the Evolution of Open Banking: A Global Perspective

The emergence of Open Banking as a pivotal transformation within the financial sector began around 2012-2013, marking a significant departure from traditional banking models. Defined by Gartner as a platform-based business model, Open Banking revolves around the sharing of data, algorithms, transactions, processes, and other business functionalities within a dynamic business ecosystem. This ecosystem encompasses a wide array of stakeholders including customers, employees, third-party developers, fintech companies, suppliers, and other collaborative partners.

API Banking: The Backbone of Open Banking

Central to the global realization of Open Banking is API Banking, where commercial banks proactively open their Application Programming Interfaces (APIs) to external partners. This strategic move facilitates seamless integration and interoperability across various digital platforms and applications, thereby fostering innovation and expanding service capabilities. By enabling third-party developers and fintech firms to access banking services such as account information, payment initiation, and transaction data, API Banking stimulates data-driven collaborations and enhances customer experiences.

Global Adoption and Examples

Internationally, numerous leading banks have embraced Open Banking by establishing their own open platforms. Institutions like Citibank, DBS Bank, and Banco Bilbao Vizcaya Argentaria (BBVA) have launched comprehensive API frameworks, granting partners access to a diverse range of banking functionalities. Concurrently, third-party API aggregator platforms such as Yolt and Truelayer have emerged, aggregating APIs from multiple banks onto a single platform. These aggregators play a crucial role in simplifying access for enterprises while generating revenue through service fees.

Regulatory Frameworks Driving Innovation

The widespread adoption of Open Banking has been bolstered by progressive regulatory frameworks aimed at promoting competition, enhancing consumer protection, and fostering technological innovation. Notable initiatives include Europe's Revised Payment Service Directive (PSD2) and the UK's Open Banking Standards, both implemented in 2018. These regulations mandate banks to facilitate secure data sharing and empower customers to manage their financial data more effectively. Similar frameworks are now being explored and implemented in countries such as the United States, Australia, Singapore, and beyond, signaling a global shift towards greater financial transparency and innovation.

Open Banking Initiatives in China

In China, state-owned banks such as Bank of China and Industrial and Commercial Bank of China (ICBC) have launched their own open platforms, offering APIs to enable seamless integration of financial services. Additionally, commercial banks like Shanghai Pudong Development Bank (SPD Bank) have innovatively introduced the API Unbounded Bank in 2018. This initiative integrates scenario-based finance into the internet ecosystem through advanced API architectures, paving the way for enhanced financial inclusivity and digital economy integration.

The evolution of Open Banking represents a fundamental reshaping of the financial services landscape worldwide. By embracing API Banking and fostering collaborative ecosystems, banks are not only enhancing operational efficiencies but also driving customer-centric innovation. As regulatory environments continue to evolve and global adoption expands, Open Banking is poised to unlock new opportunities for financial institutions, fintech firms, and consumers alike, ushering in a more interconnected and accessible era of banking services.

Challenges and Responses in Open Banking

Undoubtedly, every concept has its dual aspects, and as Open Banking progresses, it brings along its share of risks and challenges.

Barrel Effect of Information Security:

In the traditional banking model, institutions operate within closed systems, focusing primarily on their own information security and risk management capabilities. However, with the advent of Open Banking, banks are required to establish connections with multiple partners, introducing security challenges akin to a barrel effect. Risks are magnified at the weakest link unless all banking partners maintain robust information security technologies and risk management capabilities. Addressing this challenge requires banks to conduct comprehensive end-to-end assessments of their partners and assist less secure entities in enhancing their risk management capabilities. This approach ensures that collaborative alliances can effectively withstand cyber threats, safeguard data integrity, and protect all entities within the ecosystem from potential financial losses, breaches of confidentiality, reputational damage, and compromised information security.

Efficiency of Partner Connectivity:

The success of Open Banking hinges on seamless collaboration between banks and their partners to deliver enhanced value to users. However, varying corporate cultures, philosophies, and disparities in technological proficiency among different enterprises can impede the smooth implementation of partnerships. As the number of banking partners grows, optimizing connectivity efficiency becomes increasingly critical. To mitigate these challenges, banks can streamline product standards during the open banking process, facilitating scalable and rapid deployment. Moreover, leveraging innovative technologies such as public blockchain can reduce connectivity barriers, enabling enterprises to swiftly deploy solutions and enhance overall connectivity efficiency.

Privacy Protection of Data:

Data sharing forms the cornerstone of Open Banking's operations and value proposition. The introduction of stringent regulations like the EU GDPR has heightened concerns about data privacy. Banking data is particularly sensitive, necessitating rigorous measures to protect user privacy against unauthorized access and breaches. Technologies like blockchain offer robust solutions with tamper-proof records and advanced encryption, making them instrumental in enhancing data privacy. Many organizations are exploring blockchain applications for secure data transmission and exchange systems, ensuring that sensitive user information remains confidential and accessible only under authorized conditions.

Organizational Cultural Adaptation:

Traditional banks often grapple with challenges in innovation due to rigid structures, high costs, and prolonged decision-making processes. These are consequences of centralized technical architectures and complex organizational hierarchies. Embracing the Open Banking paradigm demands a departure from centralized thinking and a shift towards innovative, agile, and streamlined organizational structures. Adopting scalable technology architectures and agile management practices enables banks to expedite product innovation cycles and seize emerging market opportunities promptly. This transformation minimizes internal friction caused by outdated systems, positioning banks to navigate the dynamic landscape of Open Banking effectively.

Revolutionizing Banking Apps: FinClip's Innovative Open Banking Solution

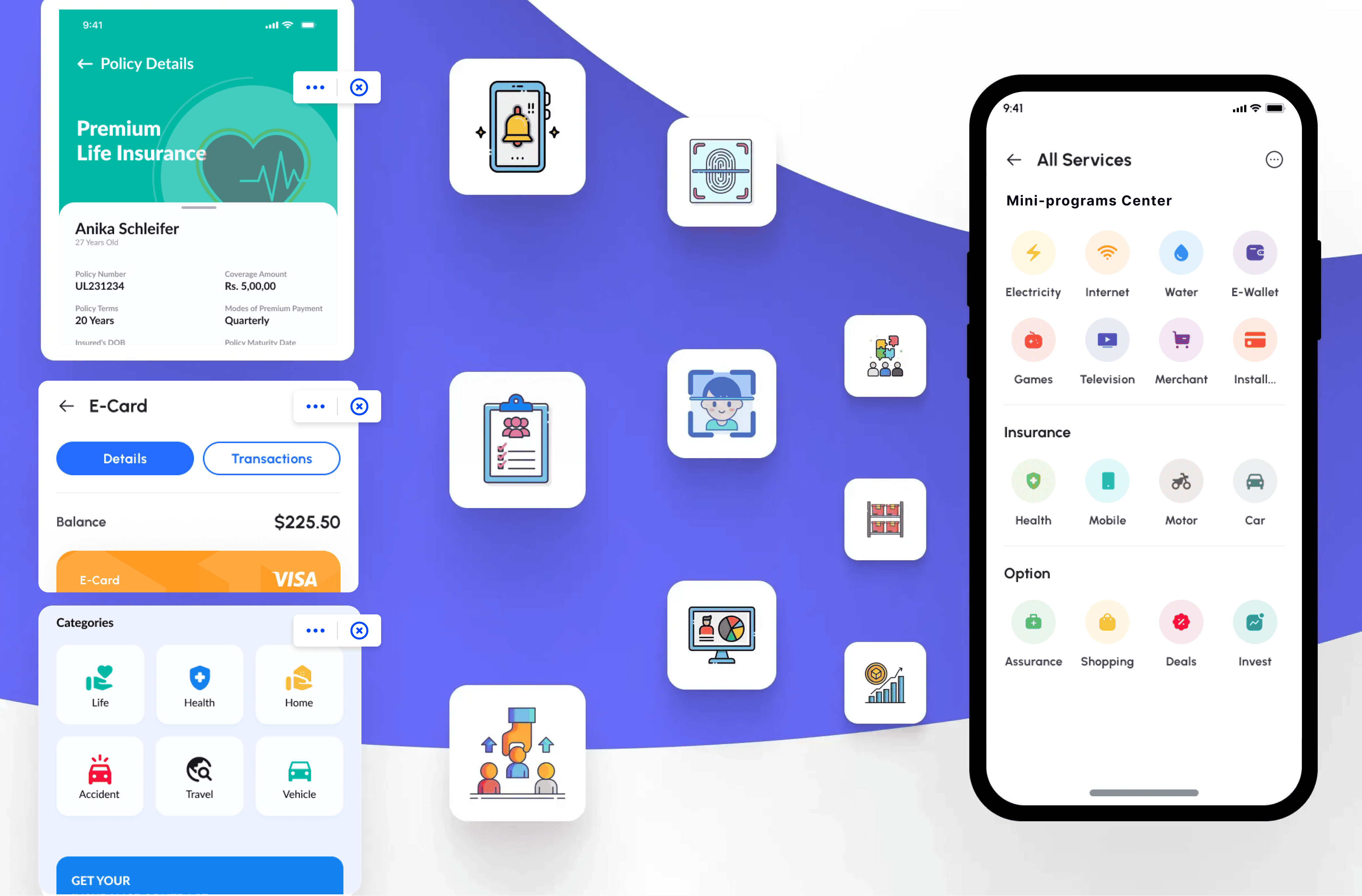

In today's fast-paced digital landscape, the demand for efficient and flexible banking applications has never been higher. Recognizing this need, FinClip has introduced a groundbreaking Open Banking solution aimed at enhancing the development efficiency and versatility of banking apps through its innovative FinClip SDK.

Key Features:

Efficient Development: At the core of FinClip's solution lies a dynamic and scalable development architecture tailored for mobile banking applications. By integrating the FinClip SDK, banks can seamlessly substitute various business function modules with mini-programs. These mini-programs are independently developed, tested, and deployed, supporting hot updates without disrupting the main banking app. This approach significantly reduces the frequency of full-scale app updates, allowing banks to swiftly adapt to changing business requirements and iterate their services rapidly.

Mini-App Ecosystem: A key feature of FinClip's solution is its capability to empower banking apps to build and manage their own Mini-App store. This unique feature enables banks to establish a digital ecosystem within their app environment. By leveraging FinClip, banks can seamlessly integrate third-party mini-apps from trusted partners. These mini-apps complement the bank's core financial services, enriching the app's functionality and offering customers a diverse range of services within a single platform.

Robust Security: Security and compliance are paramount in the banking sector. FinClip addresses these concerns with its robust risk-control capabilities. Banks using FinClip can monitor and manage compliance and security risks of Mini-Apps in real-time. This includes the ability to deactivate mini-apps instantly from user devices if any compliance or security issues arise. Such real-time control ensures that banks can innovate confidently, test new business ideas, release features swiftly, and withdraw them if necessary without compromising on security or regulatory compliance.

FinClip's innovative approach not only streamlines app development processes but also fosters a culture of innovation within banking institutions. By enabling quick deployment of new features and services through mini-programs, banks can stay agile in response to market demands and customer expectations. This capability not only enhances customer experience but also strengthens the competitive edge of banks in the rapidly evolving fintech landscape.