How the Super App of Major Commercial Banks Is "Assembled"

With the proliferation of internet financial platforms and the advancement of banks toward mobile digital transformation, in recent years, banking businesses have been continuously shifting from offline to online platforms. More and more users prefer to complete transactions, payments, and financial management through mobile banking, thus increasing the importance of mobile banking apps.

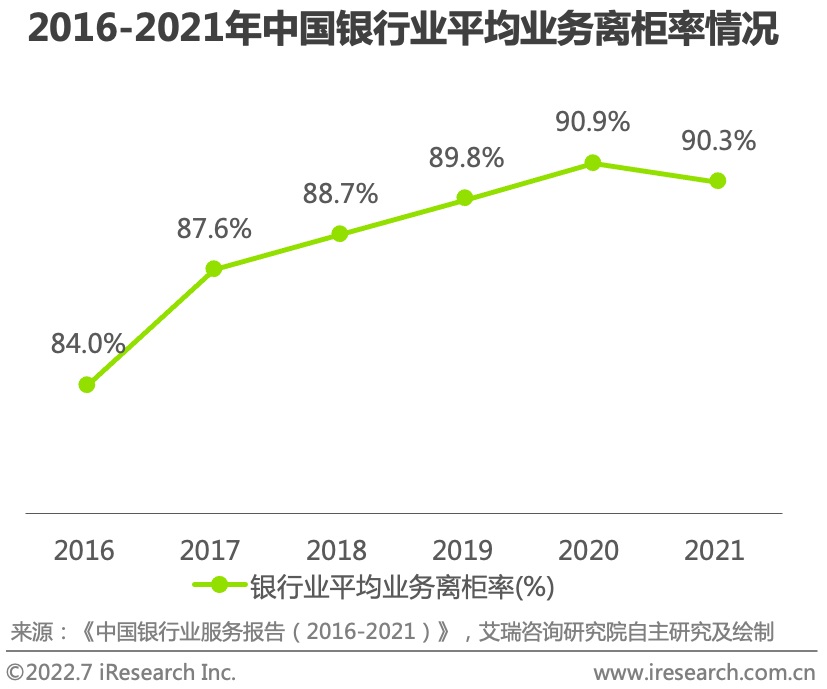

According to iResearch's analysis on the Chinese mobile banking app market in 2022, since 2016, the average rate of business transactions conducted away from traditional counters in the banking industry has shown an upward trend. By 2021, over 90% of banking transactions were conducted away from counters. As of June 2022, the total monthly active users of mobile banking apps in China have reached 570 million, indicating significant growth in user scale. Meanwhile, the number of offline banking branches has been steadily decreasing. For instance, the six major state-owned banks reduced their offline branches by over 3,000 from 2016 to 2021.

The number of online transactions continues to grow. However, with more users, the existing mobile banking apps have revealed some notable shortcomings that need attention.

How to Efficiently Manage a Large User Base

Mobile banking apps have gradually become an important channel for banks to serve customers. However, these apps still face challenges in terms of functionality, user operation, and development agility, which affect customer satisfaction and loyalty.

IT Architecture Challenges for Rapid Agile Delivery

On the one hand, mobile banking apps need to frequently launch activities to cater to various online marketing scenarios. On the other hand, the existing outdated system architecture, with its complex codes and increasing merging times, leads to high costs for iterative releases. The tight coupling of systems causes headaches for development teams, making it difficult for current apps to conduct efficient agile iterations.

Insufficient and Incomplete Consumer Scenarios

Most mobile banking apps offer only basic financial services such as transfers, inquiries, and payments. These financial services are not deeply integrated into users' daily life scenarios. They generally lack local life services that are more relatable to users' consumption scenarios, thus failing to meet diversified customer needs.

Low User Engagement

Currently, the main internet traffic is concentrated on leading platforms like WeChat, Alipay, and Douyin, occupying most of users' fragmented time. Banks have started to use mini-programs to enter social platforms like WeChat for business services. While this has accumulated a large number of users, it has further cannibalized mobile banking app traffic, resulting in low user engagement for these apps.

Amid the drive for digital transformation across the banking sector, solving the above common issues has become a real challenge.

Mini-Programs as a Winning Tool for Bank Marketing

With increasing mobile penetration, platforms like WeChat control most user traffic. To align with user habits, banks have had to deploy their services through mini-programs. For instance, the number of mini-program users of ICBC, CCB, CMB, and ABC has all surpassed 100 million, with ICBC's "ICBC Pocket Life" having as many as 120 million monthly active users. The main types of mini-programs launched by banks include:

Financial service mini-programs that offer account inquiries, transfers, bill payments, etc., without needing to access the bank app or website.

Marketing promotion mini-programs that provide various marketing activities such as coupons and discounts, which can also offer personalized recommendations based on user data.

Consumer finance mini-programs offering services like installment payments and loans.

Investment and wealth management mini-programs providing services such as funds and stocks.

Besides platform traffic and user habits, why else should banks continue to invest in mini-programs?

Because mini-programs are "lightweight," with a small size, no need for downloads or installations, they can flexibly support various financial services, marketing activities, etc., while offering users a native app-like experience.

Additionally, mini-programs are quick to spread. They inherit the universality of HTML5 while retaining the mobile-end experience of apps, making them suitable for dissemination across social platforms, thus achieving rapid reach and viral marketing.

Technically, mini-programs can be developed simply and independently. Through backend management, they can be published directly via up-and-down shelving, supporting hot updates without app updates, thus addressing the long and complex release process of online mobile banking apps and quickly responding to business needs.

A Large Commercial Bank: Efficiency and Openness as Key Breakthroughs

A large commercial bank aims to develop its super app based on its existing mobile banking app. Combining current technology and the development trends of super apps like WeChat and Alipay, it plans to "assemble" its super app through mini-programs, fostering a collaborative service and technology ecosystem. The goal is to achieve dynamic updates and flexible expansion in app functionalities through a "mini-programmed" approach, with backend management supporting internal and external mini-programs.

Industry Context: Large commercial bank mobile banking app

User Base: Over 100 million users

Key Approach: Technological architecture upgrade, super app ecosystem, multi-end operation for user acquisition

After several rounds of technical selection discussions, the bank chose FinClip mini-program container technology as the key tool. As a market-leading mini-program technology foundation, FinClip's private deployment ensures no data privacy or information security concerns. Moreover, a fully privatized SDK, management backend, development tools, etc., give the bank control similar to major internet platforms.

Agile Development with Loose Coupling

By integrating the FinClip SDK, the bank's mobile banking app gained the capability to run mini-programs. This means various business functionalities can be carried out via mini-programs, developed and tested independently, with support for hot updates, and without interference from the main app, thus addressing the lengthy and complex release process and quickly responding to business needs and iterations.

In terms of user experience, mini-programs strike a good balance in performance and flexibility, leveraging system UI, thread collaboration, and caching technologies to offer an interaction experience nearly identical to native apps, superior to H5.

Additionally, after integrating the FinClip SDK, the app can support numerous third-party features and content through plugins, solving functional expansion challenges with "low thresholds" and addressing trust, security, privacy protection, and management issues between the bank and plugin providers.

In and Out, Building an Open Bank Super App

With FinClip mini-program container technology, the bank's mobile banking app incorporates numerous quality internal and external mini-program services such as utilities payments, movie ticket bookings, food delivery, and more. By combining these with its financial services, it creates customized financial services, enriching the usage scenarios of the app. The app has already launched local life service mini-programs, effectively leveraging external resources to collaboratively serve users.

Additionally, with private deployment of FinClip, the bank can build its technology ecosystem, unifying interfaces, standards, and specifications, allowing any organization or individual to develop content. This is akin to Apple's App Store with millions of app developers, where the bank serves as the "app store" operator, managing app reviews and listings.

Multi-End Operation, Enhancing User Engagement

With FinClip's compatibility with WeChat mini-program syntax, the bank quickly and cost-effectively launched its WeChat mini-programs on its mobile banking app. This encourages users to gradually shift to the bank's app for business transactions, offering an experience indistinguishable from WeChat mini-programs. Coupled with diverse mini-program entrances, the app can reach users anytime, enhancing user engagement.