The Rise of Financial Super Apps: Revolutionizing Banking and Beyond

The world has entered the era of the digital economy, with the digital wave sweeping across the globe. Digital technology has become the new engine of development, providing a vast stage for the flourishing of the digital finance industry. With the deepening development of the digital economy, technological empowerment has become the industry consensus for the financial sector to achieve high-quality development. Technological leadership and innovation-driven approaches have provided momentum for the digital transformation of the financial industry.

While finance super apps may not be a recent phenomenon in terms of IT trends, having been around for at least half a decade, their disruptive impact continues to escalate. These applications are rapidly gaining prominence in Asian countries like China, Vietnam, Indonesia, Singapore, and others.

So, what fuels the ascent of finance super apps, how do they influence both consumers and businesses, and what risks do they entail? This article seeks to uncover the answers.

What is the Financial Super App?

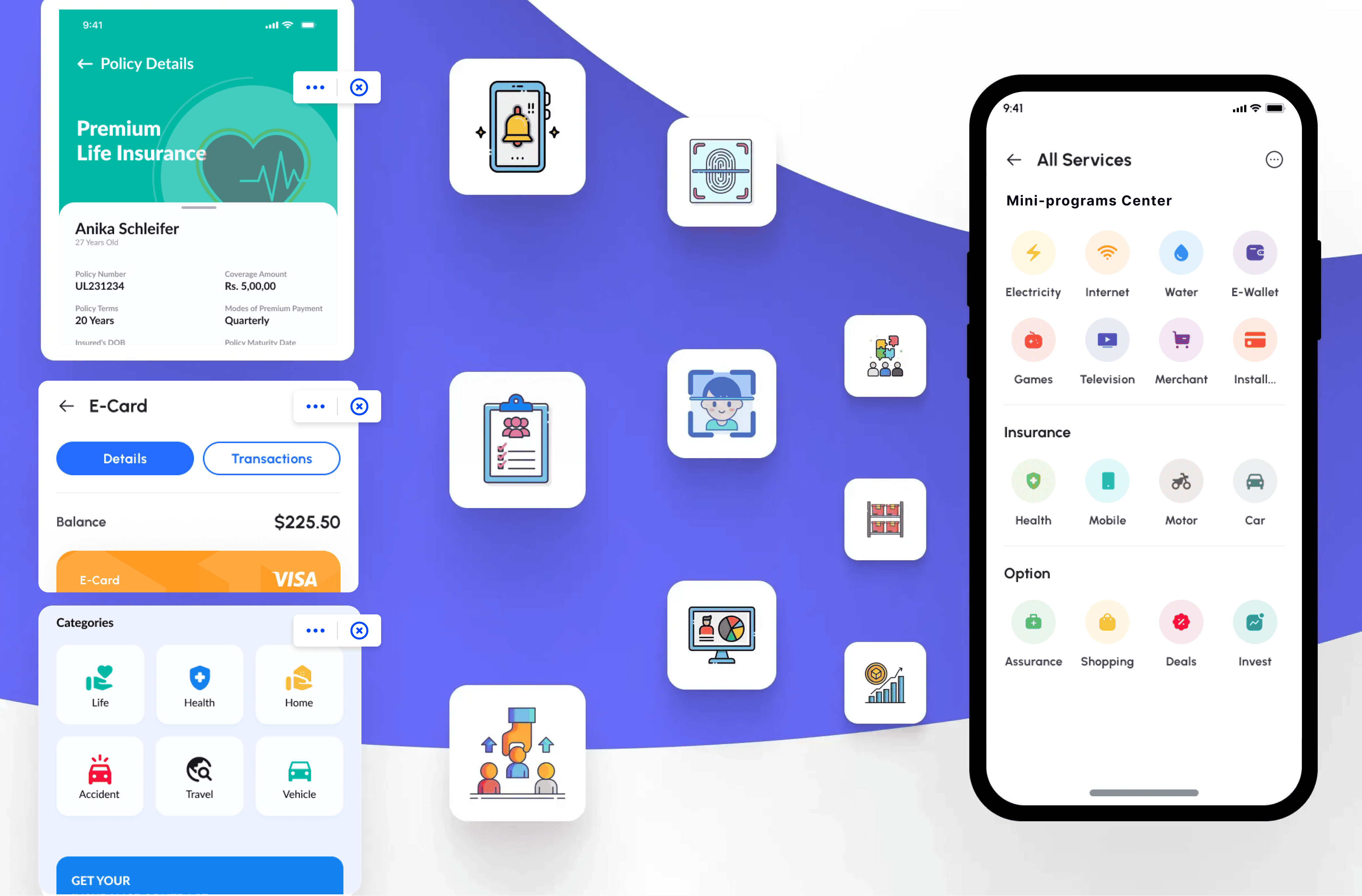

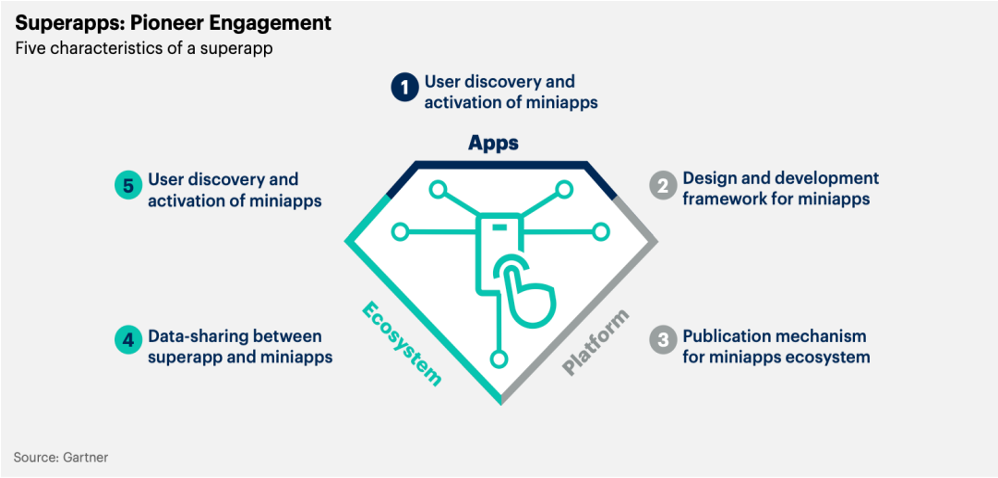

A super app is an application that combines app, platform, and ecosystem functionalities, housing a collection of specific function mini-applications (mini apps) that can be added or removed based on business needs. It not only possesses its own set of functions but also serves as a micro-application platform for third-party developers to develop and publish. This means that a single super app is capable of providing a wide range of services, enabling users to manage every digital aspect of life – from chatting with friends, gaming, and sharing pictures to purchasing tickets, planning vacations, streaming movies, and even paying for transportation.

Gartner predicts that by 2027, half of the population will be employing multiple super apps, marking a notable transformation in the mobile app landscape. Originating from Asia, these super apps initially emerged as messaging platforms before diversifying their functionalities to include mobile payments, e-commerce, ride-hailing, food delivery, and social networking. Their popularity in Asia has soared due to their simplicity, adaptability, and capacity to streamline mobile devices, thereby enhancing financial organization.

Envision a solitary application that caters to all your financial requirements – that's the essence of a Fintech Super App, a groundbreaking platform revolutionizing the financial landscape. By amalgamating diverse financial services like banking, budgeting, investing, payments, insurance, and wealth management, it streamlines the financial management process. Gone are the days of juggling numerous apps for banking, budgeting, investing, or money transfers. Say goodbye to the hassle of remembering countless passwords or navigating cumbersome interfaces. A Financial Super App serves as the ultimate all-in-one hub, simplifying your financial journey and empowering you to effortlessly handle everything from bill payments to stock purchases with just a few taps.

Financial Super App Features

Financial Super Apps are revolutionizing the way people manage their finances by offering a wide range of features and services all within a single platform. These apps serve as comprehensive ecosystems tailored to meet the diverse needs of users, providing convenience, efficiency, and customization like never before. Here are some key features commonly found in Financial Super Apps:

Digital Payments: Enable secure and convenient digital transactions, including mobile wallets, peer-to-peer transfers, QR code payments, and integration with popular payment platforms.

Mobile Banking: Access and manage bank accounts, check balances, make transactions such as fund transfers and bill payments, and monitor financial activities seamlessly through the app.

Investment Management: Offer investment options such as stocks, bonds, mutual funds, and digital assets, along with portfolio tracking, real-time market data, investment analysis, and personalized recommendations.

Personal Financial Management: Provide tools for budgeting, expense tracking, goal setting, bill payments, and alerts to help users effectively manage their finances and achieve their financial goals.

Financial Insights: Utilize AI and machine learning to offer tailored insights and suggestions based on user data, identifying opportunities for improvement and providing relevant financial solutions.

Security and Privacy: Implement robust security measures such as encryption, two-factor authentication, and biometric authentication to safeguard user data and transactions.

Credit and Lending Services: Offer tools and services for loan calculations, eligibility checks, credit cards, peer-to-peer lending, and other lending options to cater to users' credit needs.

Connecting with External Services: Financial super apps seamlessly link with e-commerce platforms, ride-hailing services, utility bill providers, and loyalty programs to offer users a smooth and integrated experience. It's crucial for these apps to integrate with payment platforms such as Stripe and PayPal as well.

Customer Support: Provide responsive customer support through AI-powered chatbots, in-app messaging, ticketing systems, or dedicated support teams to address user inquiries and issues promptly.

Financial Super Apps empower users with comprehensive financial management tools and services, streamlining their financial activities and enhancing their overall financial well-being.

Examples of Financial Super Apps

Here are some examples of Financial Super Apps along with a brief introduction to each:

WeChat (China): Originally a messaging app, WeChat has evolved into a comprehensive super app offering a wide array of financial services such as mobile payments, wealth management, and utility bill payments. It also integrates social networking features, making it an indispensable part of daily life for millions in China.

Alipay (China): Developed by Ant Group, Alipay is one of China's leading mobile payment platforms. It offers a plethora of financial services including mobile payments, wealth management, credit services, and insurance. Alipay's user-friendly interface and extensive network of merchants have made it a staple for conducting transactions in China.

Grab (Southeast Asia): Originally a ride-hailing service, Grab has expanded its offerings to include financial services through GrabPay. Users can pay for rides, order food, shop online, transfer money, and access various financial services such as insurance and loans. Grab's integration of multiple services into a single platform has made it a dominant player in the Southeast Asian market.

Paytm (India): Paytm started as a mobile wallet app and has since grown into a full-fledged financial super app offering services such as mobile recharges, bill payments, ticket booking, online shopping, and digital banking. Its user-friendly interface and wide range of services have made it immensely popular among Indian consumers.

Gojek (Indonesia): Similar to Grab, Gojek began as a ride-hailing app and has expanded to offer a wide range of services including food delivery, grocery delivery, courier services, and financial services through GoPay. Users can use Gojek for a variety of transactions including mobile payments, bill payments, and even investments. Gojek's diverse range of services has made it a household name in Indonesia.

The Benefits of Financial Super Apps for Customers

In today's fast-paced digital world, financial super apps have emerged as a game-changer for customers, offering a wide range of benefits that empower individuals to take control of their finances like never before.

Convenience and Accessibility:

One of the primary benefits of financial super apps is the convenience they offer to customers. Convenience reigns supreme, surpassing all other considerations. Previously, consumers had to navigate between various websites and platforms to check account balances, transfer money, and pay bills. Now, with everything they need in one place, users can easily manage their finances on-the-go, anytime and anywhere. Whether it's checking account balances, paying bills, or transferring funds, customers can perform a wide range of financial transactions with just a few taps on their smartphone. This level of accessibility ensures that customers have complete control over their finances at all times.

Simplified Financial Management:

Financial super apps simplify the complexities of financial management for customers. By providing a centralized platform for all their financial needs, these apps eliminate the need to juggle multiple accounts and platforms. Customers can view their entire financial picture in one place, making it easier to track spending, monitor savings, and plan for the future. With features like budgeting tools and expense tracking, customers can make more informed decisions about their money and achieve their financial goals more effectively.

Personalized Financial Solutions:

Another key benefit of financial super apps is the ability to offer personalized financial solutions tailored to the individual needs of customers. By analyzing user data and transaction history, these apps can provide personalized recommendations and insights to help customers make better financial decisions. Whether it's suggesting investment opportunities, offering savings goals, or alerting users to potential budgeting pitfalls, financial super apps empower customers to make smarter choices with their money.

Cost Savings and Rewards:

Many financial super apps offer cost-saving features and rewards programs that incentivize customers to use their platform. From cashback offers and discounts on purchases to waived fees and lower interest rates, these perks can help customers save money and maximize their financial benefits. Additionally, some super apps offer exclusive deals and promotions with partner merchants, further enhancing the value proposition for customers.

Security and Peace of Mind:

Security is a top priority for customers when it comes to managing their finances online. Financial super apps employ advanced security measures, such as encryption, biometric authentication, and multi-factor authentication, to safeguard user data and transactions. By prioritizing security, these apps provide customers with peace of mind knowing that their financial information is protected against unauthorized access and fraud.

The Benefits of Financial Super Apps for Businesses and Banks

The rise of financial super apps has transformed the way businesses and banks operate, offering a wide range of benefits that enhance efficiency, customer engagement, and growth. These all-in-one platforms provide a centralized hub for financial services, catering to the diverse needs of both businesses and banks. Here, we explore the significant advantages that financial super apps offer to businesses and banks alike.

Expanded Market Reach:

Financial super apps serve as a gateway for businesses to tap into a larger customer base. By integrating their services into these platforms, businesses gain access to millions of users who rely on the app for their financial needs. This expanded reach allows businesses to connect with potential customers they may not have reached through traditional channels.

Enhanced Customer Engagement:

Financial super apps serve as a powerful tool for businesses and banks to engage with their customers on a deeper level. Through personalized promotions, targeted advertisements, and seamless transaction experiences, businesses and banks can nurture stronger relationships with their customers. By providing a user-friendly interface and convenient access to financial services, super apps encourage greater customer loyalty and satisfaction.

Streamlined Operations:

For businesses and banks, operational efficiency is key to success. Financial super apps streamline operations by consolidating multiple financial functions into a single platform. From processing transactions and managing accounts to analyzing data and generating reports, super apps offer a comprehensive solution that simplifies day-to-day operations. This not only saves time and resources but also improves overall efficiency and productivity.

Access to Advanced Analytics:

Data analytics is a valuable tool for businesses and banks seeking to gain insights into customer behavior and market trends. Financial super apps provide access to advanced analytics tools that enable businesses and banks to track performance, identify opportunities, and make data-driven decisions. By analyzing user data and transaction history, businesses and banks can tailor their offerings to better meet customer needs and preferences.

Cost Savings:

Utilizing a financial super app can result in significant cost savings for businesses and banks. By leveraging digital channels for transactions and payments, businesses and banks can reduce the costs associated with traditional banking methods, such as processing fees and currency exchange rates. Additionally, the streamlined operations and efficiency gains achieved through the use of super apps can lead to overall cost reductions for businesses and banks.

Innovation and Adaptability:

Financial super apps are constantly evolving to meet the changing needs of businesses, banks, and consumers. With continuous updates and new features, these platforms offer a high level of innovation and adaptability. Businesses and banks can leverage this flexibility to stay ahead of the curve, respond to market trends, and capitalize on emerging opportunities. By embracing the latest technologies and trends, businesses and banks can remain competitive in an increasingly digital landscape.

Challenges in the Digital Transformation Journey of Financial Institutions

Currently, financial institutions have widely recognized the urgency of digital transformation and its significance for the industry's healthy and efficient development. With increased investment and output in financial technology, the digital transformation of financial institutions has begun to take shape. However, digital transformation is a complex and systematic undertaking, requiring a suitable direction based on one's development goals and actual conditions. This primarily includes business digitization, governance digitization, and data value realization, with major financial institutions exhibiting the following characteristics in their transformation exploration:

The trend of digital transformation has become apparent, with the application of data assets becoming crucial.

Initially, major financial institutions focused on exploring business digitization during the early stages of transformation. The emphasis was on actively leveraging financial technology to support business development, expand service reach, improve service efficiency, and accumulate data assets, with the core still being business-led technological innovation. Today, with a deeper understanding and iterative practice of digitalization, the digital transformation of financial institutions has reached a climax. The core path of transformation involves building new enterprise-level digital capabilities, controlling data assets, and achieving scalability, agility, and differentiated application, becoming key to successful transformation.

Information silos have been persistent problems for many years, and development costs remain high.

Data is the core foundation of digital operations, yet the current situation is marked by barriers between internal and external data within financial institutions, lacking customer-centric data coordination and unified planning. Complex system call interfaces have led to data silos between head and branch offices. Especially for small and medium-sized financial institutions, data lacks interconnectedness, leading to long data development cycles that fail to meet the self-service analysis needs of business personnel, alongside high development, operation, and management costs.

Traditional architectures need improvement, with security and flexibility being key.

The root cause of information silos lies in the need for enterprises to improve their technical architectures. Firstly, security is a concern, as digitization requires interconnectedness with industries, customers, regulatory agencies, etc., with information security serving as the foundation of openness. Secondly, structural rigidity hampers digitization transformation, requiring multi-party online collaboration. With the increasing complexity of financial institution IT systems, traditional technical architectures find IT departments acting as "data movers," handling a large amount of data but lacking business scenario support, making it challenging for business personnel to understand the intrinsic value of data, hindering data from being solidified as assets.

Content homogenization requires operational supplementation.

Traditional financial institutions' products, services, and content are relatively homogeneous, making it difficult to respond quickly to market demand changes and meet customer's personalized needs. Similar content products provided by various channels lead to high customer turnover and increased maintenance costs for existing customers. Many operational and marketing activities of financial institutions are single-point, lacking systematic design and long-term user relationship cultivation. Digital operations require the design of a customer lifecycle operational management framework based on customer insights, along with efforts to establish a two-way interaction mechanism with customers.

Interactive Innovation: Financial Super Apps Bring New Opportunities

The development of financial technology has opened up new opportunities for financial apps. Emerging interactive forms have allowed financial institutions to explore more diversified interaction scenarios, including video, audio, live streaming, AR, VR, and even the concept of the metaverse. These innovations are restructuring the traditional logic of "people, goods, and scenes", with apps serving as indispensable main platforms.

Financial super apps offer several advantages:

Enhanced Collaborative Effects, Agile App Architecture: Super apps enable unified collaboration among cloud, network, edge, and end, facilitating multi-dimensional progress in new-generation operation modes, ecosystem integration, and scene interpenetration. The loose-coupled architecture of super apps, coupled with flexible content deployment and gray release capabilities, makes it possible to precisely provide function iterations to segmented user groups at designated times. This enables rapid response to customer experience demands, leading to reduced innovation costs and trial-and-error costs.

Clear Ownership and Controllable Security, Digitization of Content Assets: In platform-based models, multiple parties are often involved, and not all rights are monopolized by a single entity. Determining the ownership of rights among platform operators, users, and ecosystem partners becomes a key issue. Super apps serve as critical carriers for separating and unifying the ownership of publishing, distribution, circulation, and usage rights. Financial institutions can build their own ecosystems through super apps.

Breaking Enterprise Boundaries, Differentiated Content Marketing: Content marketing through financial institution super apps will become a crucial means of digital marketing. As articles, short videos, live streams, and graphics become the mainstay of user engagement, "content" serves as a medium of communication and connection between financial institutions and users. Super apps can break enterprise boundaries, introduce partners, and enrich financial education, reading, and process-oriented content through audio and video presentations. This completes the entire transaction process, constructs a differentiated system, and enhances user engagement through content operations.

Enhanced Operational Capabilities, Diversified Interactive Experiences: For users, financial institutions can enhance active scale and duration based on the AARRR (user lifecycle model) operation. Utilizing the management backend of super apps to dynamically control the visibility range of mini-programs based on user characteristics enables intelligent recommendation of marketing activities and business functions tailored to individual users, achieving personalized marketing at scale. Whether it's banking, securities, insurance, funds, or trusts, its new form is deeply integrated with the Internet industry and the Internet ecosystem. Financial institutions' content production, through audio, video, live streaming, AR, VR, digital humans, digital employees, and other technological innovations, drives traffic and expands business within the app content ecosystem, providing users with immersive experiences, and ultimately completing transactions.

The Role of Open Banking in Super App Evolution

Open banking plays a pivotal role in the evolution of super apps by enabling seamless integration of financial services from multiple institutions into a single platform. Through open banking APIs (Application Programming Interfaces), super apps can securely access and aggregate user data and financial accounts from various banks and financial institutions.

This integration allows super apps to offer a wide range of financial services, including banking, payments, investments, insurance, and more, all within one convenient interface. Users can manage their finances more efficiently, make informed decisions, and access personalized recommendations based on their financial data.

Moreover, open banking promotes innovation and competition in the financial industry by fostering collaboration between traditional banks and fintech companies. It encourages the development of new services and features that enhance the user experience and drive financial inclusion.

Overall, open banking facilitates the transformation of super apps into comprehensive financial platforms that empower users with greater control over their finances and access to a diverse range of financial products and services.

FinClip: Empowering the Creation of Financial Super Apps

FinClip leverages the mini-program model to assist financial institutions in creating their own super apps, characterized by low development costs, secure control, premium user experience, and open integration. From a technical standpoint, mini-programs offer modular development and risk isolation. In terms of user experience, they provide an experience comparable to native apps. And from an openness standpoint, mini-programs have low learning curves, high traffic potential, and the ability to quickly attract developers and businesses.

Modular Development for Enhanced User Experience at Low Cost:

Super apps need to modularize their engine to support the operation of various lightweight applications, achieving platform-based construction. FinClip adopts a “mini-program” development model: by introducing the FinClip SDK platform, it realizes a hybrid development mode of 'Native + Mini Program,' breaking down the app into individual components. This modular development approach offers flexibility, easy debugging and upgrading of individual modules, collaborative development without interference, and enables hot updates, avoiding the long release cycles of traditional apps.

Secure Sandbox for Risk Isolation and Control:

FinClip's mini-program security sandbox technology is a cloud-controlled device-side (including IoT) security sandbox technology. It uses the distributable and circulable code format of mini-programs as software forms, serving as the technical foundation for the next generation of enterprise application software.

Premium User Experience and Flexible Service Deployment:

With features like mini-program grayscale release and A/B testing, financial institutions can leverage FinClip's low-code configuration for rapid deployment and ongoing operation of mini-programs. By combining their financial service capabilities, they can enrich app usage scenarios and enhance user experience comprehensively. FinClip's modular, embedded, lightweight, and flexible product features empower banks, securities firms, and insurance companies to create open banking and digital brokerage services, driving breakthroughs and innovations in intelligent operations, regulation, and compliance technology.

Open Ecosystem Collaboration for Co-creating Value:

Traditional app ecosystems often lack integration capabilities, making it difficult and costly to introduce partner business scenarios into proprietary apps. FinClip supports WeChat mini-program syntax WXML, enabling the low-cost and rapid introduction of high-frequency WeChat mini-programs into proprietary apps. It also assists in standardizing the process for merchant onboarding, enabling dynamic management of merchants and content. By rapidly establishing an ecosystem for proprietary app mini-programs, FinClip facilitates platform construction, collaboration integration, hosting and distribution, traffic interchange, and explores business models with partners, addressing user acquisition and revenue challenges.